Shomi may have been a lackluster streaming service in many respects, but regardless of how you feel about the platform’s closure, it’s a monumental hit to cord cutters north of the wall and the Canadian content industry in general.

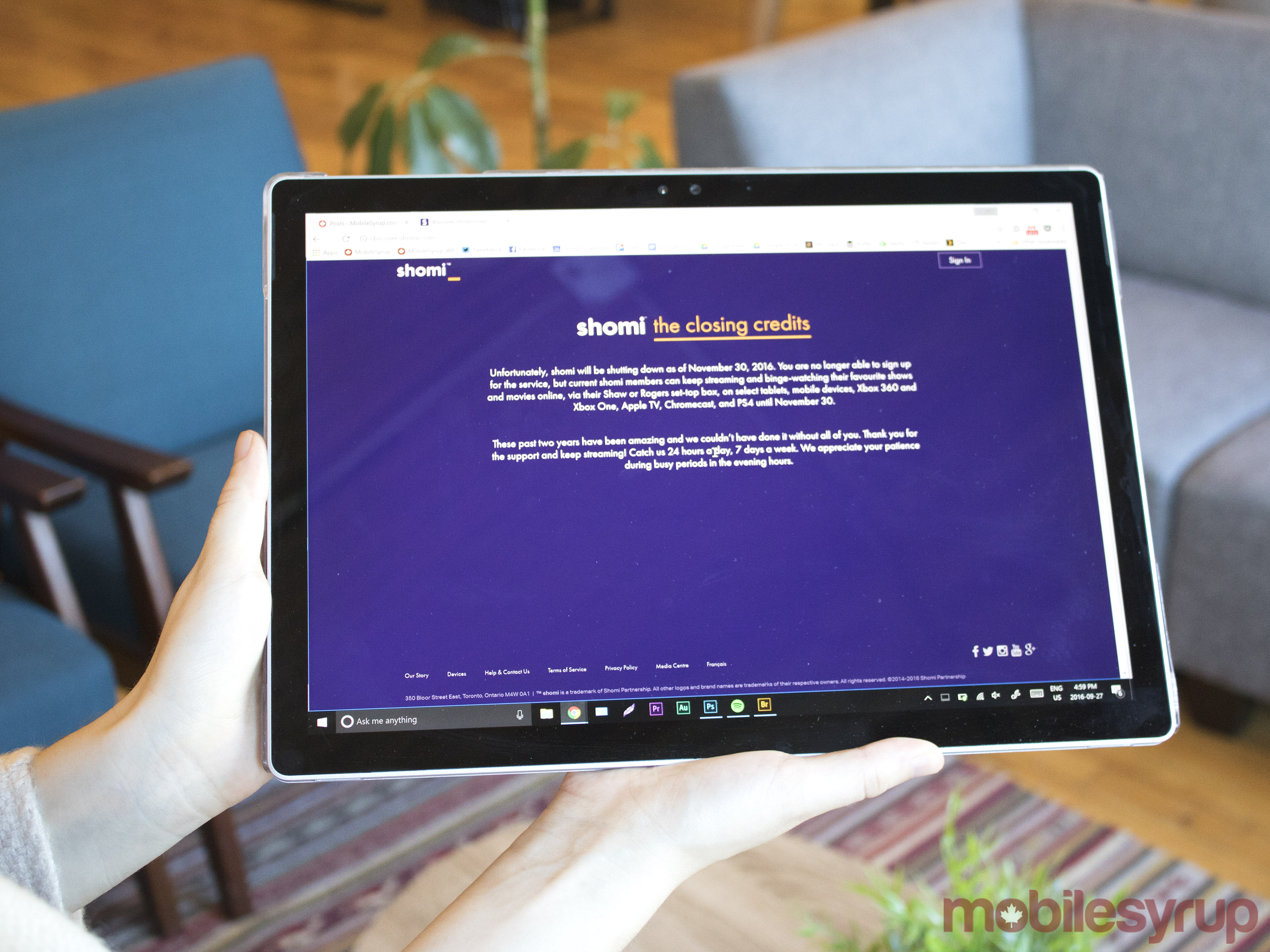

Rogers’ and Shaw’s streaming platform Shomi, has announced that it’s closing on November 30th, resulting in a $100 million to $140 million write-down on the telecom’s third-quarter as a result of the streaming service’s closure.

“We tried something new, and customers who used Shomi loved it. It’s like a great cult favourite with a fantastic core audience that unfortunately just isn’t big enough to be renewed for another season,” said Melani Griffith, senior vice-president of content for Rogers in a recent statement sent to MobileSyrup.

Rogers and Shaw have never released Shomi’s subscriber numbers, though just a few weeks ago the service touted that it has received 143 million total ‘video plays.’ Toronto-based data tracking firm Solutions Research Group also release a study that indicates Shomi is used in less than four percent of all Canadian households.

Furthermore, the study indicates that even with Shomi and CraveTV’s subscriber numbers combined, both services have fewer than one seventh of Netflix’s total Canadian subscriber numbers (Netflix doesn’t publicly release regional subscriber numbers). Shomi’s senior vice president, however, recently revealed that the service has 900,000 subscribers, though it’s unclear if that number includes just paying subscribers — this is unlikely — or total users. Rogers currently offers free Shomi subscriptions with a number of wireless packages which could inflate this number considerably.

The main question surrounding Shomi’s closure is what happens to the streaming service’s various content rights. The common misconception is that shows like The Americans, Mr. Robot and Modern Family, all Shomi exclusives in Canada, will find a new home on Bell’s CraveTV and maybe even Netflix.

While this could happen in some cases, licensing contracts often include a clause that prevents television shows or movies from being resold to another platform for a specific period of time. Some programming though, specifically Amazon Prime shows that Shomi licensed, like Transparent, will likely find their way onto Roger’s services in some form.

Also, it’s likely that if a show ended up on Shomi, it’s because Netflix and in some cases even CraveTV passed on the content, or because the show’s license holders were not interested in having their content appear on the service. There are also often clauses present in licensing contracts that would prevent Shaw and Rogers from showing content on video on demand platforms other than Shomi, in most cases unless the license holder, which in this case is Rogers, obtains written consent from the content’s owner.

Shomi’s head of content and programming Marni Shulman said that the service typically signs two-year deals with content providers. Since Shomi originally launched back in beta back in November 2014 (the official launch didn’t happen until 2015), most of the deals are expiring somewhat soon. Cartt.ca also reported back in August that Shaw was looking for a way out of its co-ownership agreement with Rogers. This could have encouraged Rogers to ditch the service earlier than planned.

It’s also possible that Rogers could fold many of the content rights it currently owns from Shomi into its upcoming IPTV service. In an interview with Alphabeatic’s Peter Nowak, a Rogers spokesperson said, “Those details are still being figured out, so unfortunately I don’t have a comment at the moment.”

Now that Shomi has closed its doors it’s likely that Bell’s CraveTV will soon follow suit now that the telecom no longer needs to maintain the platform to match its rival’s services. Bell, however, claims that it has no plans to close CraveTV.

Regardless of how the closure of Shomi shakes out, the already limited streaming landscape in Canada has fundamentally changed. If a homegrown telecom like Rogers can’t compete with the streaming might of Netflix, it’s likely that U.S.-based services like Amazon Prime Instant Video and Hulu will be even further deterred from attempting a Canadian launch. Alternatively, Shomi’s closure could be a sign that Rogers’ strategy of using the now dead streaming platform as a way to funnel more subscribers to its other services, isn’t a viable business venture. This could potentially open the door for U.S. streaming services to break into the Canadian market and do it right, though this happening is unlikely.

One thing is for sure, with Shomi bowing out from the competition, piracy is about to get more prevalent in Canada.

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.