Let’s be honest — personal finance can be scary. Personal finance experts say parents should talk to their children about managing their money.

Meanwhile, the simple truth is most adults don’t know how to do that for themselves. There’s no high school class on money management, investing or taxes. My only “formal” money management lesson was the last week of math class in tenth grade. Sadly, that’s more than what most Canadians can say.

FinTech or Financial Technology has become a big business. Even though our wallets don’t always feel that deep, many companies want to help us spend, track, and invest what we do have. It wasn’t long ago that most consumers felt that financial products were out of their reach. Today, FitTech products give Canadians access to several excellent apps and services that will help them better manage and invest their money.

Here are six apps to help you better understand your financial health:

Credit Karma

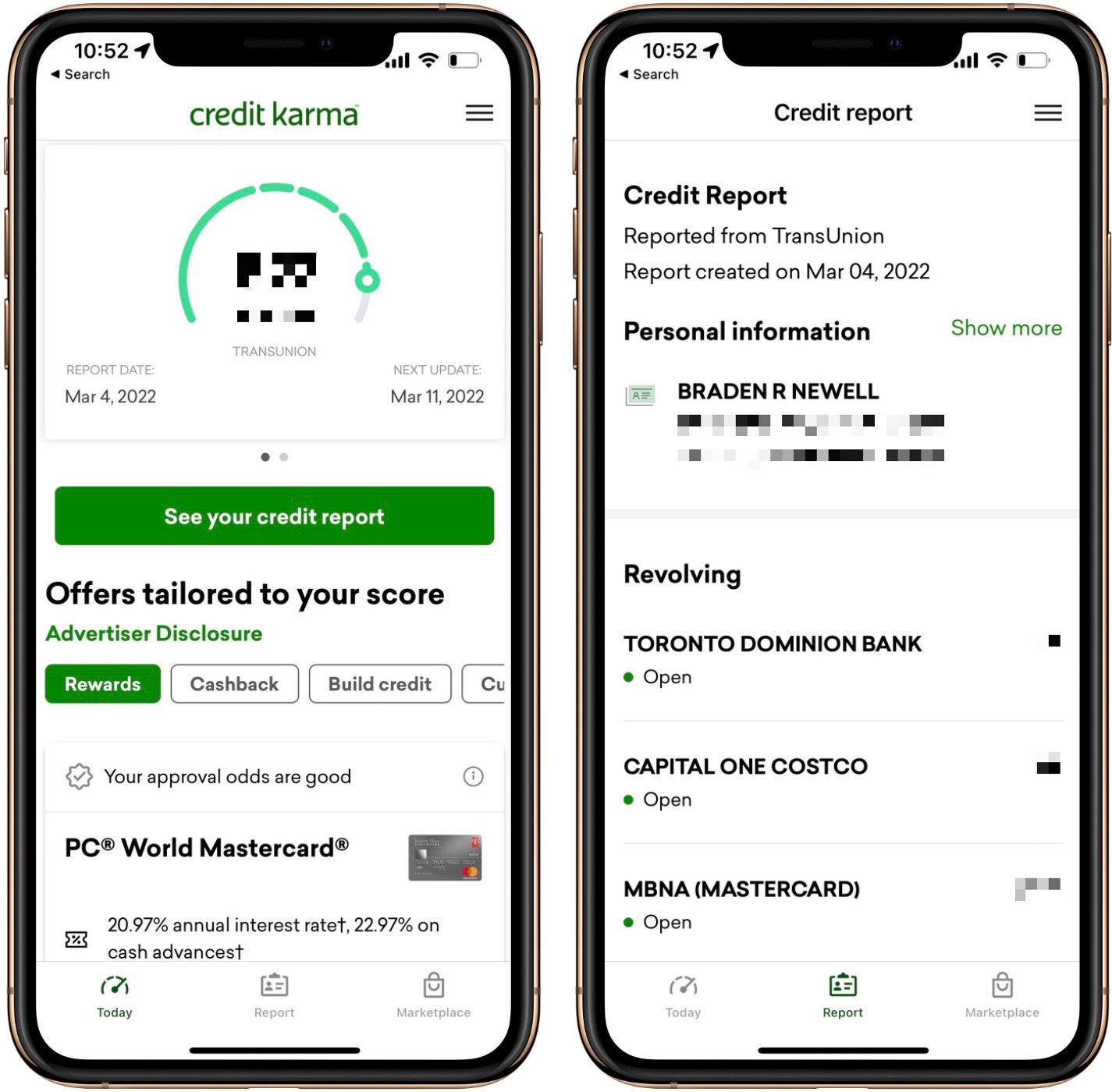

Credit scores are numbers that most Canadians don’t understand. They’re mysterious and not incredibly easy to get your hands on. Yet, they have severe influence when taking out a loan or even financing a cellphone. Credit Karma is an app that aims to provide everyone free and easy access to their credit score.

Once you sign up for Credit Karma, the app will provide your credit score and update it weekly. In addition, a secondary tab gives you a breakdown of all of the balances currently attached to your credit report and the last time your credit was checked.

Using Credit Karma does not impact your credit score. Additionally, the app is free because Credit Karma serves you non-invasive credit card offers within the app. Credit Karma has a 4.7 in both the Apple App Store and Google Play Store. You can learn more about Credit Karma on their website or download the app the Apple App Store or Google Play Store.

Mint

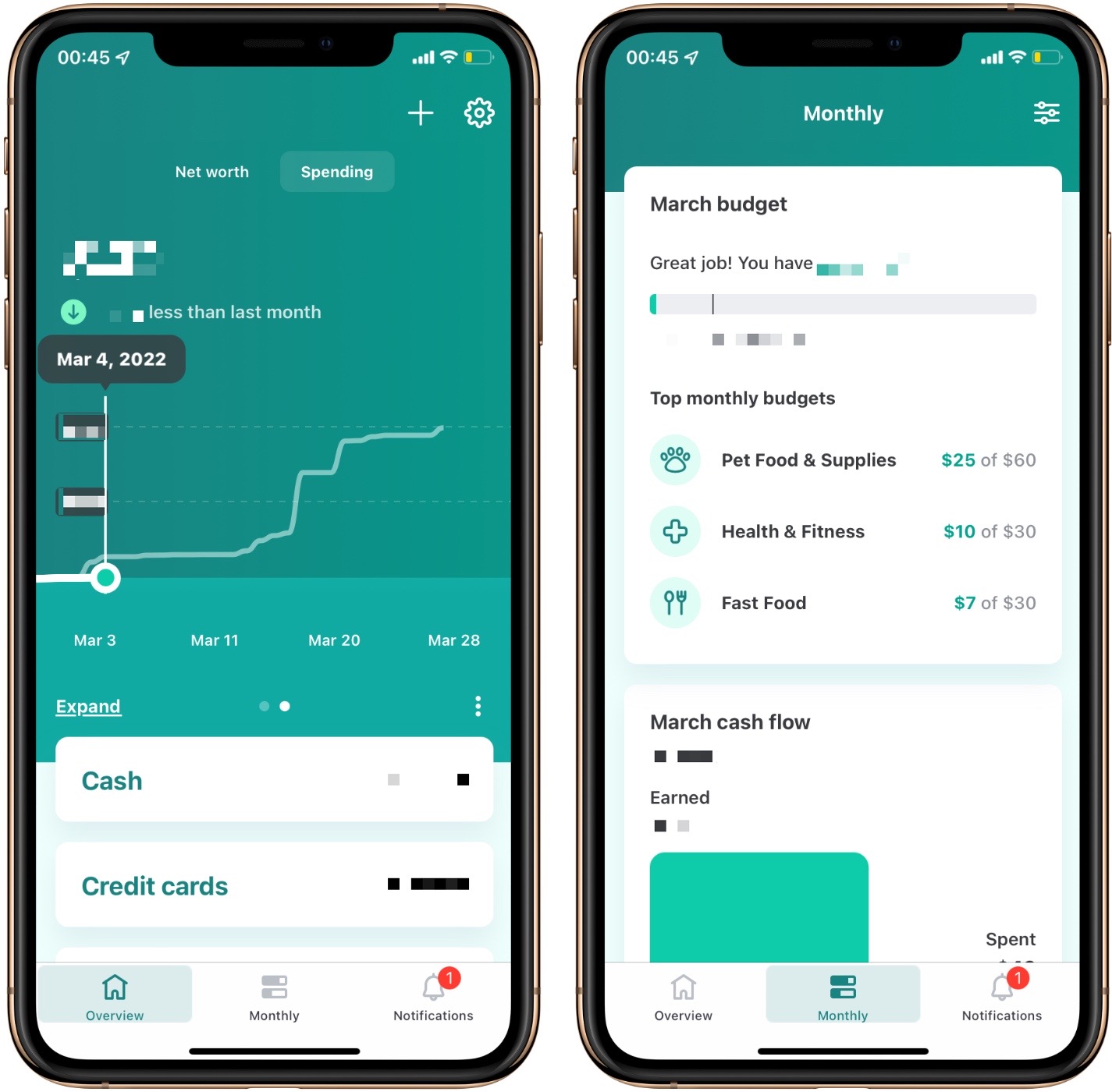

Mint is perhaps one of the most popular expense tracking and budgeting apps available. That’s not surprising given how well-designed and straightforward to use the app is. Mint allows you to connect accounts from nearly every financial institution to automatically track your income and expenses.

You can use the app to track income and spending from your bank account, credit cards, investments, and loans. Within Mint, you can customize the budget categories and make manual edits to incorrectly categorized expenses.

Mint will even notify you when subscriptions increase. In addition, Mint can help monitor your credit score and allows you to set bill payment reminders. You can learn more about the Mint app on its website or download the app for free on the Apple App Store or Google Play Store.

TD Easy Trade

TD Easy Trade is perhaps the newest app on this list. Many financial products are available to Americans that Canadians can only envy. Robinhood is a popular US stock trading app for DIY investors.

TD released the Easy Trade app in January, which offers wannabe investors a cheap and user-friendly way to get started. TD Easy Trade doesn’t charge any account fees or require any account minimus. Additionally, every year you receive 50 commission-free stock trades. Compared to the $9.99 per trade set by a traditional trading account offered by TD.

TD Easy Trade offers “how-to” videos, live classes, webinars, FAQs, and a contact centre with licensed investment representatives to help early investors. You can learn more about the TD Easy Trade app on its website or download the app for free on the Apple App Store or the Google Play Store.

Acasa

If you have roommates, you may find it awkward or annoying to get their share of the rent or bills. Acasa is an app that aims to reduce that pain. Upon setting up Acasa, you create a “house” and profiles for everyone who lives there.

Roommates then accept emailed invites to the house. Once they’ve joined the app, they can get notifications and make payments within the app. Anyone within the household can add an expense, whether groceries, rent or a utility bill. That cost can then be divided equally or custom percentages for different people.

Acasa will easily show who owes how much on the Home Screen. This app helps you ensure that everyone is paid up fairly and quickly. You can learn more about Acasa on their website and download their app for free on the Apple App Store or Google Play Store.

Wealthsimple Tax

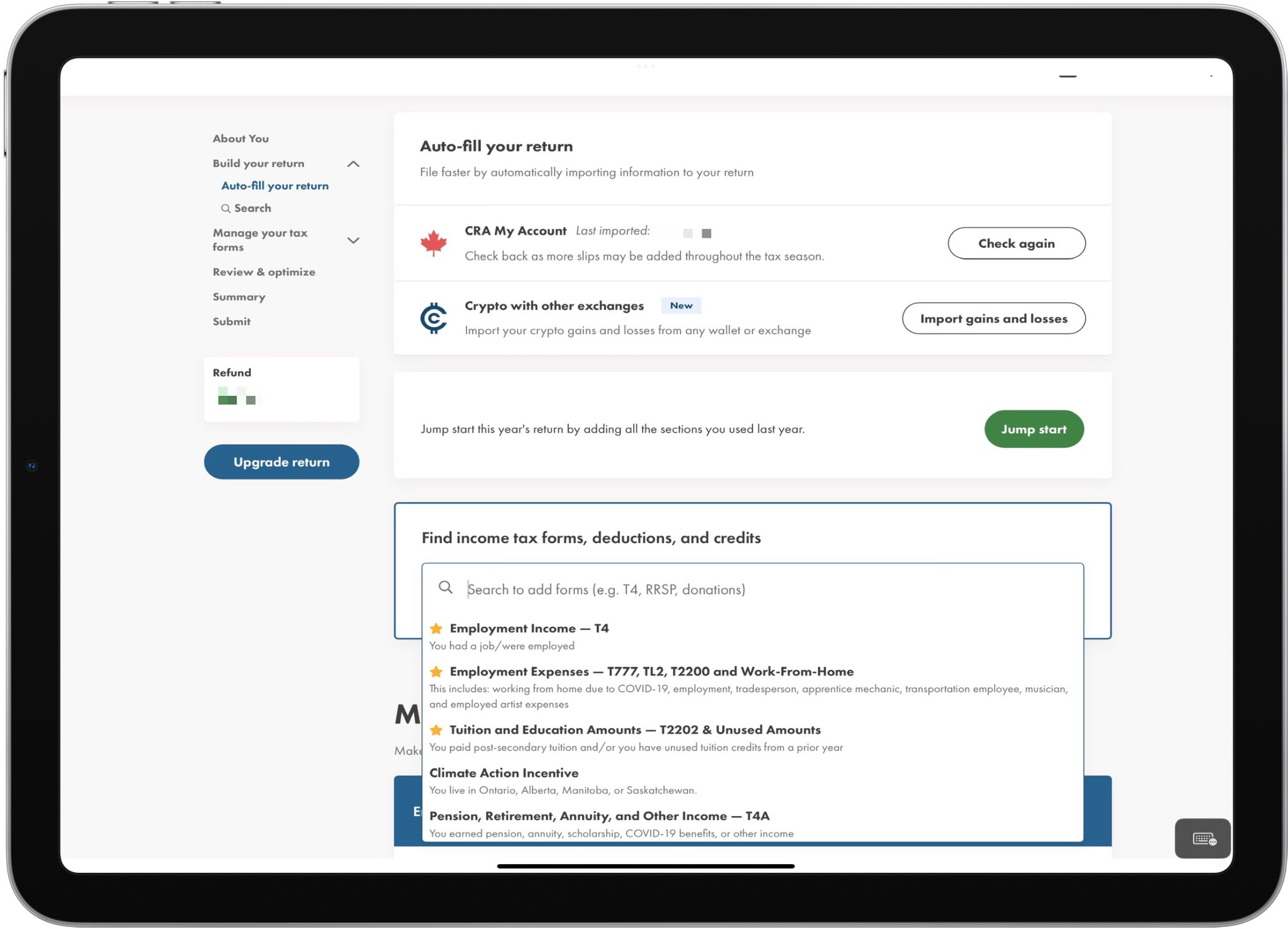

Formerly SimpleTax, the service was bought by Wealthsimple in 2019 and rebranded into Wealthsimple Tax. The service has kept its defining characteristics: a simple user interface and costs nothing to use. Wealthsimple Tax has been a popular alternative to tax software like TurboTax.

Wealthsimple Tax feels user-friendly and attempts to make doing your own taxes less daunting. Personally, I’ve been using the service for years and have always had a really great experience. Using a search engine-like box, you can search for the forms you need. The Wealthsimple Tax then guides you to fill out the boxes required. Wealthsimple Tax will let you print off the documents or Netfile them with the CRA for you.

Wealthsimple Tax is a free service that you can opt to pay any amount at the end if you so choose to. You can learn more about Wealthsimple Tax on its website or download the Wealthsimple Tax app from the Apple App Store or Google Play Store.

Moka

Many of us have trouble with saving money. Perhaps we want to save for a trip, pay down some debt, or start investing. In any case, it can be hard to save money at the end of the month. Moka is an app that works to help us save more of our money.

Moka’s premise is pretty simple—connect your bank accounts and credit cards, and every transaction you make will be rounded up. Then, Moka will take that rounded-up difference and put it towards debt repayment, savings, or investments.

Moka can also help you set up a Tax-Free Savings Account (TFSA), make donations with your space change, and give you access to a financial coach. Moka is a free app but does have a paid service for $3.99 or $15 per month. You can learn more about Moka on their website and download the app on the Apple App Store or Google Play Store.

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.