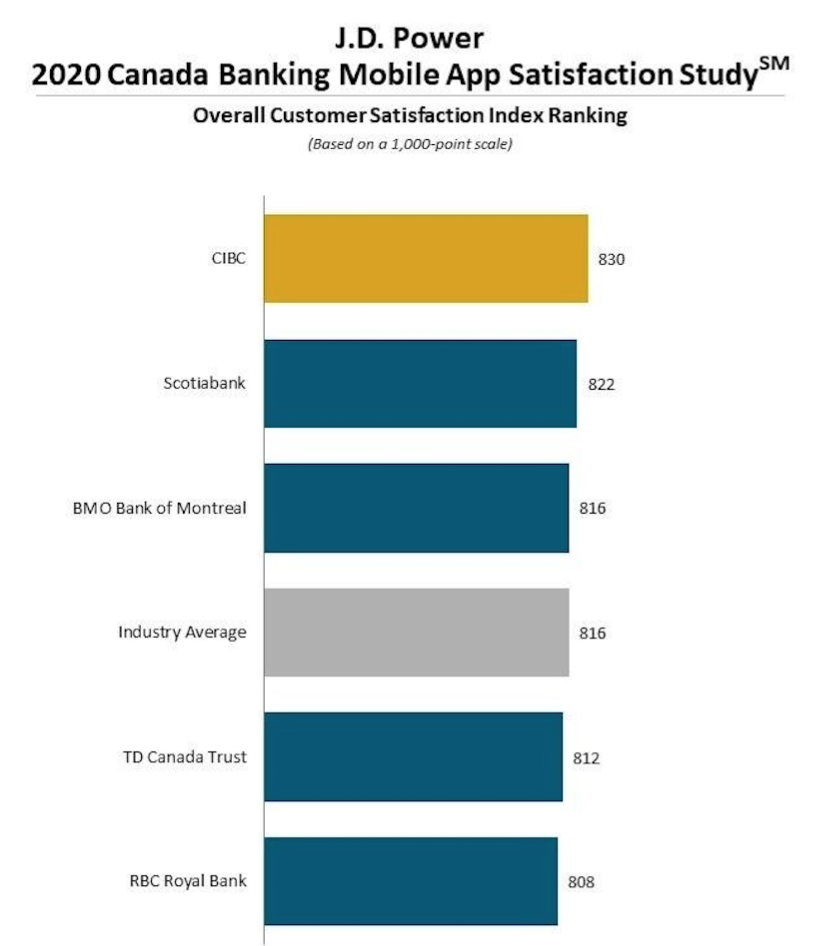

CIBC has ranked highest in terms of mobile banking app satisfaction in Canada, according to J.D. Power’s new study.

The research firm’s recent study looks at overall satisfaction with banking and credit card digital channels based on four factors, which are navigation, speed, visual appeal and content.

CIBC ranked first with a score of 830 on a 1,000 point scale. Scotiabank followed in second place with a score of 822, followed by BMO ranking third with a score of 816. The industry average was 816. TD and RBC both ranked under the industry average with scores of 812 and 808, respectively.

In terms of online banking satisfaction, Scotiabank ranked first with a score of 819, with CIBC in second place with 817. TD was close behind in third with a score of 815. The industry average score was 813, and RBC and BMO ranked under it with scores of 811 and 807, respectively.

Tangerine Bank ranked highest in terms of credit card app satisfaction with a score of 857. RBC came in second place with 843, followed by American Express with a score of 831.

The study found that the most important indicators driving overall satisfaction with apps are based on ease and speed when it comes to finding information that’s most important. For instance, when customers’ most important information is displayed right on the overview page, overall satisfaction scores improve by 57 points.

Interestingly, the study also found that banking websites in Canada outperform credit card websites, which is largely due to extensive features and functionality along with user-friendly information layouts.

“Across the studies, customer experience with mobile apps is generally better than their online experience, due largely to greater levels of perceived visual appeal and streamlined layout on mobile apps,” the study notes.

Unsurprisingly, Canadians are using their banking apps more frequently during the COVID-19 pandemic. The study outlines that 41 percent of customers said they were using banking apps more than before, and 40 percent said they were using credit cards in a contactless manner.

J.D. Power conducted this study by surveying 9,127 retail bank and credit card customers across the country between March and April.

Image credit: J.D. Power

Source: J.D. Power

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.