Vancouver-based Koho can help you make meaningful steps toward your financial goals and save money for your next big purchase. It’s quite common for tracking spending and setting savings goals, all the while targeting a purchase, to feel like a daunting task.

The Koho app can help you manage all of this.

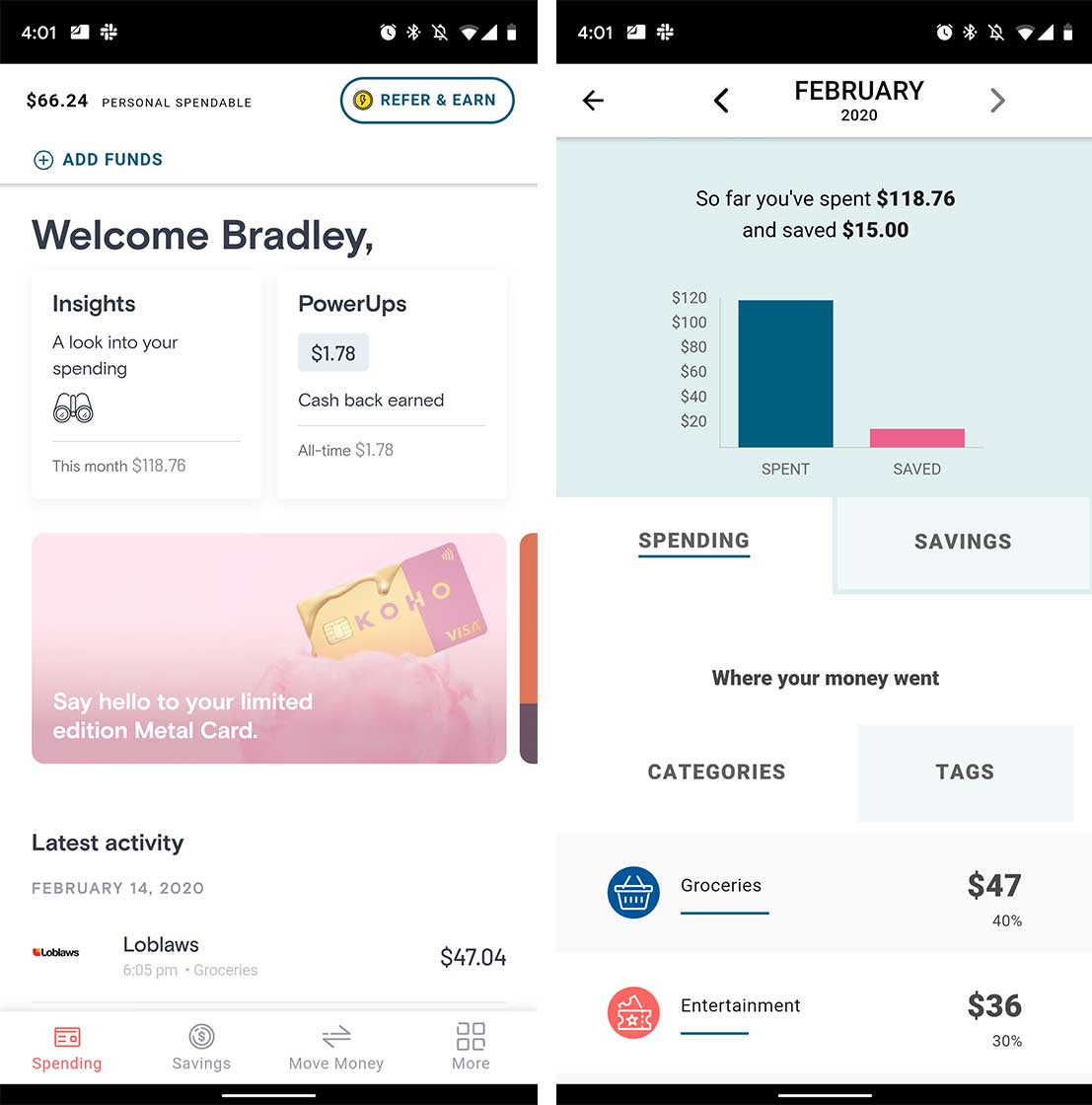

Most major financial institutions offer their own in-app features to track savings. Though it’s rare, they intuitively allow the user to set goals and see real-time updates. The Koho app acts as a financial hub where users can manage their money as well as use a reloadable Visa card for their purchases.

The Koho app is available on both iOS and Android. Once an account is created, you can link the app to your bank account or manage funds by e-transfer or direct deposit. Once funds are available in the Koho app, users can start taking advantage of the wide array of tools.

Koho’s app also supports a variety of plans. For instance, users can check out the free services available. Alternatively, there are several paid monthly subscriptions. This includes the $4/month ‘Essential’ tier, the $9/month ‘Extra’ tier, and the ‘Everything’ plan, available for $19 monthly.

Koho’s app also supports a variety of plans. For instance, users can check out the free services available. Alternatively, there are several paid monthly subscriptions. This includes the $4/month ‘Essential’ tier, the $9/month ‘Extra’ tier, and the ‘Everything’ plan, available for $19 monthly.

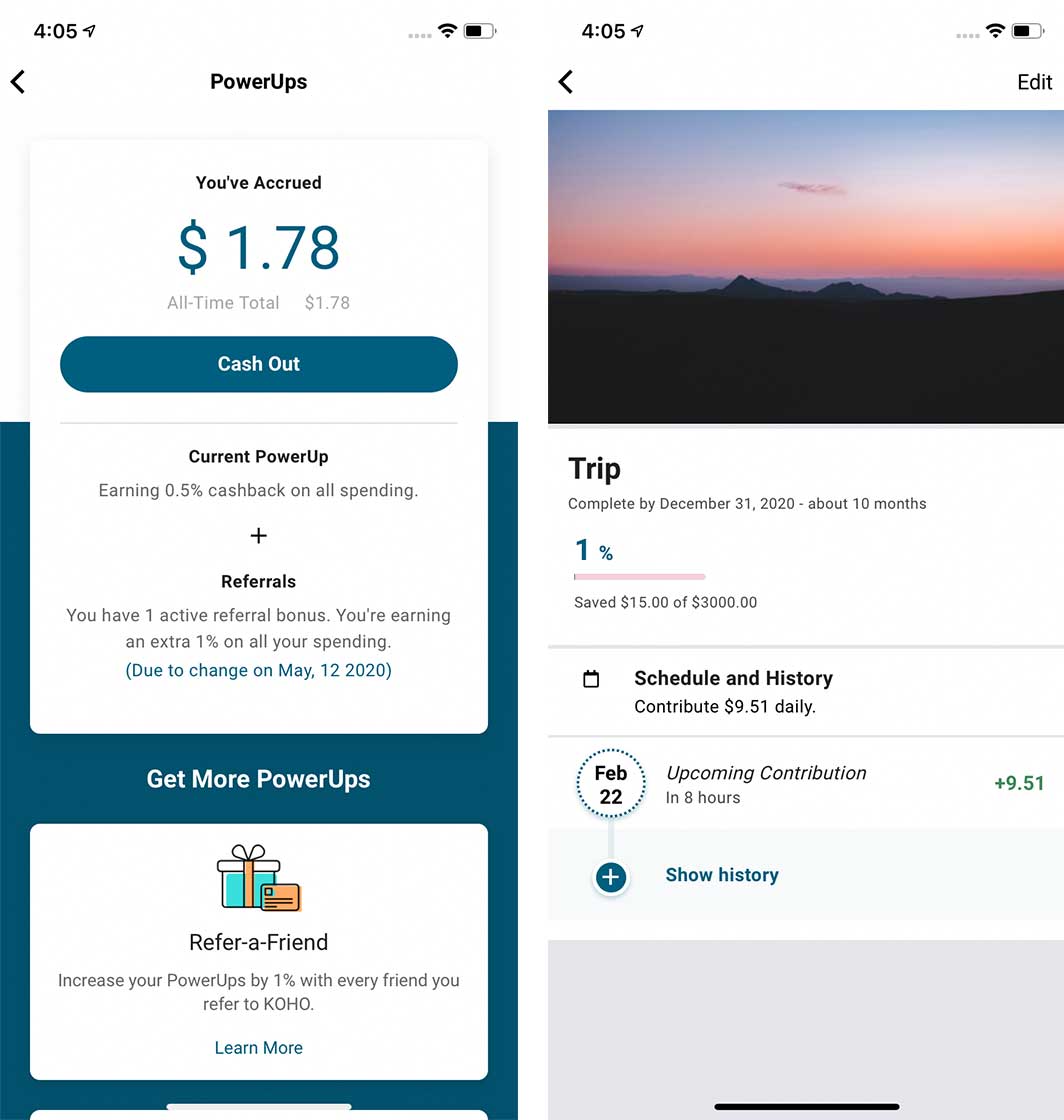

Each of Koho’s subscription plans comes with a virtual card as well as the option to have a physical prepaid Visa card. Plus, users can get up to five percent cash back on purchases. Each of Koho’s paid plans offers cash back on all purchases, even on a copy of Final Fantasy XVI.

For example, if you’re a student looking to save on a new 13-inch MacBook Air for the upcoming school year, Koho can help you set a financial goal to make that purchase. Using the ‘Savings’ goal, you can indicate when you’d like to make the purchase. The app will then take a set amount of money each day and set it aside in order for you to make that purchase by the end of the summer. If you’re in the market for a new iPhone, this is a great opportunity to set a goal ahead of the iPhone 16’s launch later this fall or snag an iPhone 15.

If you’re looking to purchase Google’s Pixel 8 or a pair of Samsung Galaxy Buds 2 Pro, the Koho app can designate an appropriate amount of daily funds to go towards that purchase. The best part is that if you have an influx of available funds, you can add it to that total, and the app will recalculate how much it sets aside from your account each day. This takes a bit of the busy work away from you, freeing up time while also assuring you hit your financial goals.

You can also make payments directly through Koho. You can load the Koho Visa card with cash through an Interact e-transfer or link it to your bank account. A Koho Visa card is then shipped to the user free of charge. This visa card can then be used to make everyday purchases at a grocery store or grab a coffee. Of course, this can also be beneficial when making smaller purchases on a new USB-Charger or MagSafe Charger.

Another way of contributing savings towards a PlayStation 5 or Xbox Series X is Koho’s RoundUps perk. With each purchase, Koho will take a few dollars, rounding up your purchase to the nearest $1, $5, $10, etc. This is a great way of accumulating passive savings when making day-to-day purchases. Letting the app do the heavy lifting over a few months can result in a nice chunk of change. This can then go towards that prospective purchase of yours.

Users of the Koho app also have the opportunity to earn interest across their entire account. From savings to spendable cash, an interest rate of 0.5 percent is available. However, that percentage goes up to as much as four percent when investing in paid subscriptions.

Currently, Koho does have a referral program in place. Active users can share a code with a friend or family member. Once registered, a $20 credit is applied to both accounts within the first 30 days after their first purchase.

With summer now upon us, it’s a great time to make a savings plan for the rest of the year. As many new smartphones, laptops, accessories, and games come down the pipeline, it’s reasonable to want to set financial goals, especially before the holiday season.

More information on Koho’s app and plans can be found here.

MobileSyrup utilizes affiliate partnerships. These partnerships do not influence our editorial content, though we may earn a commission on purchases made via these links that help fund the journalism provided free on our website.

Image credit: Koho

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.