Koho is a Canadian online digital banking/saving app that can be used in a few different ways, but I find it works best as a complement to your regular banking system.

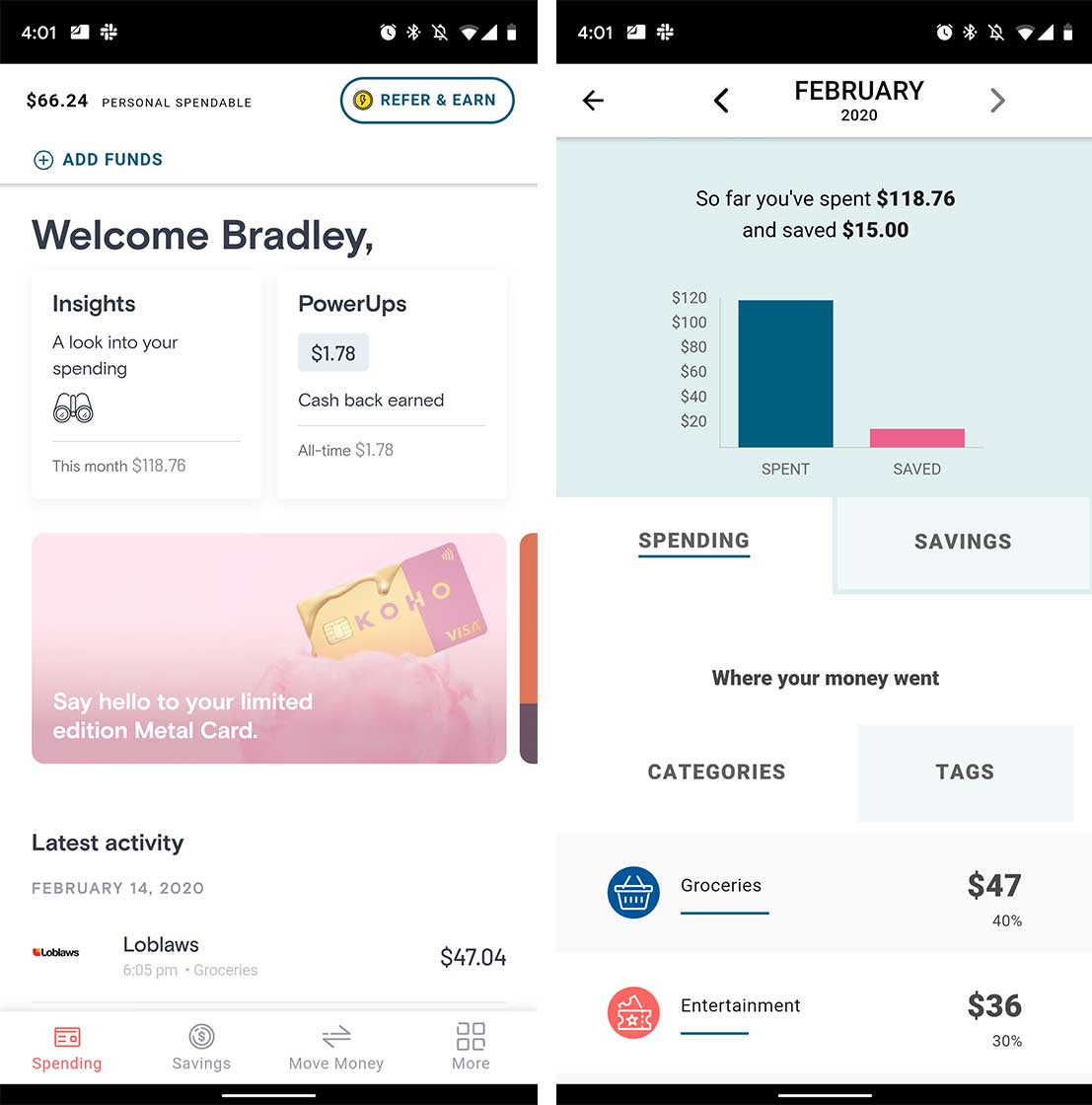

In essence, Koho is an app that allows you to manage your money and a reloadable Visa card. This lets you track your spending, set savings goals and more. Overall, the app is super good looking and feature-wise, I think it offers more tools than most online banking apps.

The first thing you need to do is sign up for the service on the app and order a card. If you have an iPhone or a Samsung device, you can use either Apple or Samsung Pay to start spending right away.

To spend money with Koho you need to load your app with cash from your regular bank account. You can do this by e-transfering, a direct deposit or by linking it to your bank account. For me, I decided to budget out my money in my RBC app and then send my spending cash to Koho. That way, once I spend all my money in my Koho account, I know that I’d hit my weekly spending limit.

Perks

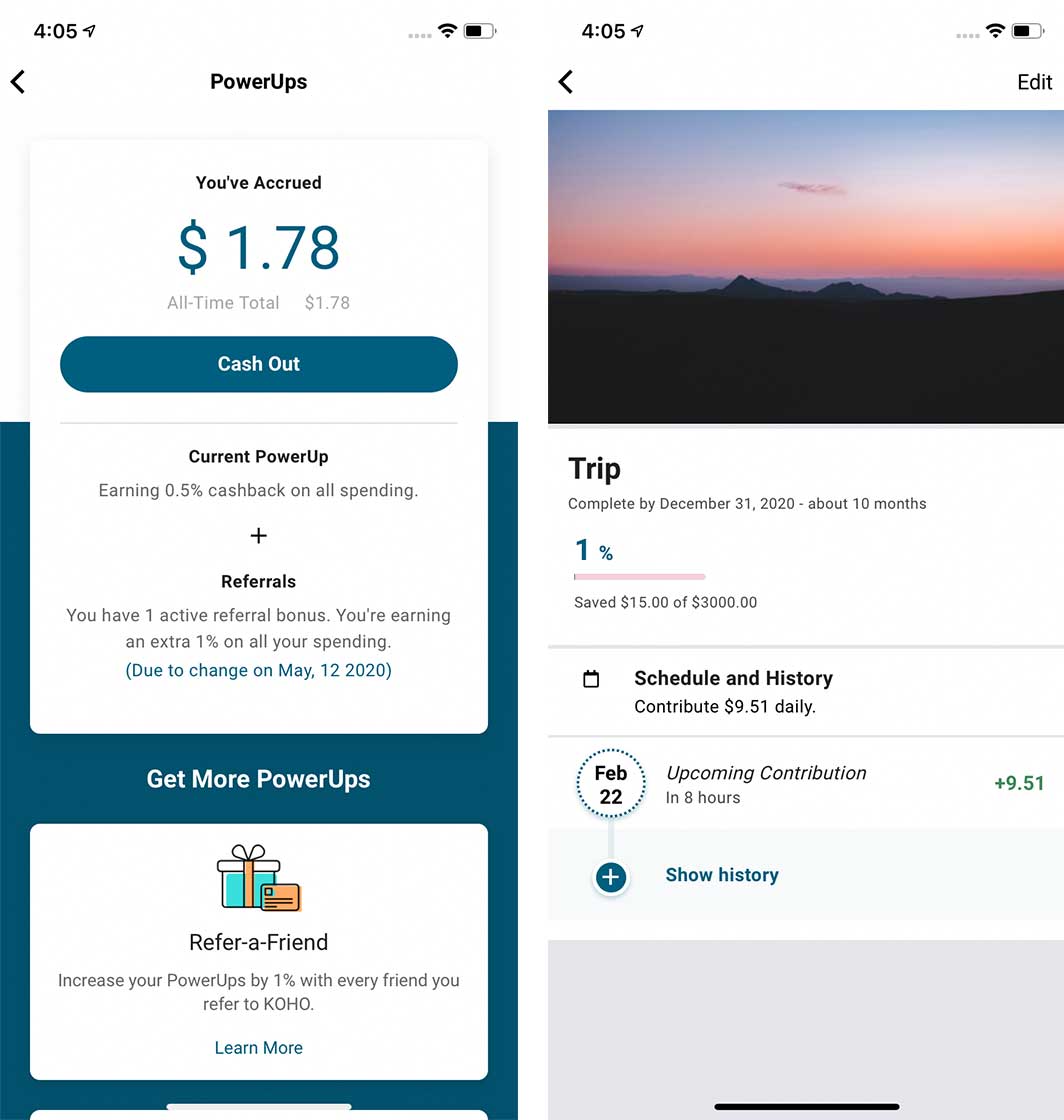

As a banking app, Koho has a few perks. The first one is called ‘PowerUps,’ and they help you earn cashback from your spending. Every account gets a minimum of 0.5 percent cashback, but if you refer more customers or subscribe to Koho Premium, you’ll get a better cashback percentage.

You can cash out your accrued cashback at any time and ad it to your spendable cash account.

Another perk is called ‘RoundUps,’ and it takes a few dollars every time you spend by rounding up your purchase to the nearest $1, $2, $5 or $10.

You can also make joint accounts so you can share your spending and saving goals with a partner.

Finally, you can make ‘Savings’ goals to help you save money for something like a trip or anything you need to gather a lot of money for. For example, I added a goal to save $3,000 throughout the year for a trip. The app knows that if it takes a minimum of $9.51 from my account every day, I’ll have enough money by December 31st. If I add more money to the savings goal before then, it will reduce how much it takes from my account every day.

Is this app worth using?

For me, I think Koho is 100 percent a convenient tool for saving and spending. I’m an RBC client, and the RBC app is filled with tons of saving features, so I don’t use Koho for tracking my spending and saving. That said, I do enjoy having a sperate card with its own balance for my weekly spending money.

In essence, Koho lets me use my RBC app to cover my regular savings and my monthly bills, while Koho is just for day-to-day spending. It may seem like a lazy thing, but having a separate spending account that I don’t need to do any math to figure out how much I can spend is handy.

For a long time, I thought that Koho was more of a gimmick than something that could actually help me budget. Still, after using it for a few weeks, I think it’s one of the few apps that I’d recommend to people who are looking for relatively simple ways to manage their spending.

My only real issue with the service is that it doesn’t work with Google Pay, so I have to carry the card around to use it when I’m using my Pixel phone.

You can download the app and get started for free on both iOS and Android.

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.