News broke late last night that the Canadian Bankers Association (CBA) was about to announce “how banks will operate in this new world.” This new world is the “mobile wallet” and has an end goal of eliminating physical cash and storing all forms of payment info on your NFC-enabled smartphone, feature phone or tablet.

Today the CBA sent out a press release outlining the guidelines for mobile payments in Canada. This set of “voluntary guidelines” is known as the “Mobile Reference Model” and isn’t just for the big banks, but also for credit unions, and will address consumer “safety and security” concerns, plus “allow for innovation in the marketplace.” The aim of the guidelines is to “provide clarity to the marketplace as various participants consider how they will meet the growing demand for mobile payments in Canada.” Curious who helped back the rules? Here’s the complete list of financial organizations: BMO, National Bank, CIBC, Credit Union Central of Canada, Desjardins Financial, Royal Bank of Canada, Bank of Nova Scotia and TD Bank.

The rules are based on 6 guiding principles: Open, Safe & Secure, Responsive to End User & Merchant Needs, Standards Based, Sustainable and Focused on Mobile Technology Initiated Transactions. Below are the full details of each.

Open:

– Allows for different business models

– Fosters innovation

– Ensures competition among market participants

Safe & Secure:

– Protects confidential personal, financial, and transactional information within the mobile payments ecosystem

– Facilitates secure interactions between Financial Institutions and the mobile payments ecosystem

Responsive to End User & Merchant Needs:

– Provides for ease of use, speed, availability, security, transparency, choice and consistency for users

Standards Based:

– Establishes clearly defined standards essential for interactions between financial institutions and

the mobile payments ecosystem

– Aligns with the Canadian regulatory environment and avoids overlap with existing standards

– Considers and respects international standards as a means of facilitating interoperability

Sustainable:

– Creates a path forward for standards to support the long term viability of mobile payments in

Canada

– Encompasses activities between Financial Institutions and the mobile payments ecosystem

– Adapts over time as technology and the ecosystem evolve

– Allows for economically viable business models that accelerate mobile payments adoption for the

mobile payments ecosystem

Focused on Mobile Technology Initiated Transactions:

– Focuses on payment transactions and enabling capabilities

– Considers pre-payment and post-payment services that enable transactions

– Considers multiple currencies and payment types

– Focuses on mobile NFC enabled devices and NFC enabling technologies

The entire report is 133 pages and there’s some interesting notes. Currently the only accepted mobile payment brands are MasterCard, Visa and Interac. No mention of Enstream or Zoompass. It does though mention “The Wallet Provider,” specifically Google Wallet, ISIS and “other 3rd Parties.” So perhaps we’ll see Google Wallet launch in Canada this year (it was rumoured they would). The report notes that in order for NFC mobile payments to word there must be “the right hardware and software” and that “Interoperability between the Mobile Network Operators (MNOs, e.g. Rogers,Bell, Telus, Public Mobile, Wind, Videotron) and payment networks (e.g. Visa, MasterCard, Interac) is a key objective for these guidelines.” Rogers recently applied to acquire a banking license with “Rogers Bank” so we’ll possibly even see them come out with some sort of complete mobile solution angle.

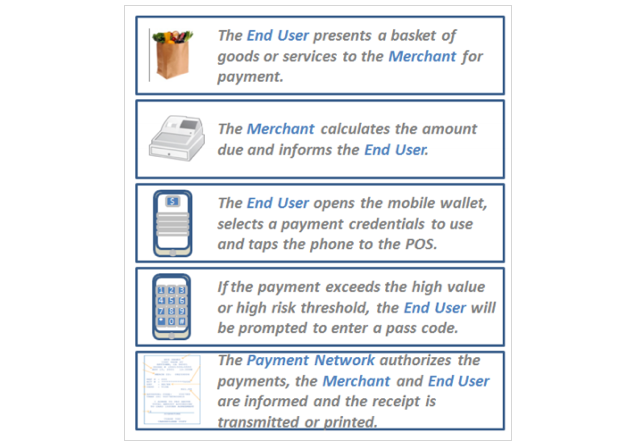

In addition, there looks to be two types of mobile transactions, “convenience transactions” and “hight risk transactions.” Convenience transactions “are performed frequently and quickly (e.g.

purchasing a transit ticket or a coffee)” and are determined by the payment network. The hight risk transactions “must be approved by the end user via a Card Verification Method (CVM). There’s seven accepted CVM choices that range from Tap and go, Pass code, PIN verification, Tap and Confirm and Tap, Confirm and Reconfirm.

Since security, specifically fraud, will be a major concern for consumers and the industry. The guidelines state that “each ecosystem participant should only have access to the minimum information required to perform its primary role… To be a part of a safe and secure payment ecosystem it is very important

that the mobile wallet be compliant with payment industry guidelines. A key part of the guidelines and

safety and security is what data can and cannot be captured by the mobile wallet.”

There was no Canadian mobile payment stats listed in the document, only that these guidelines will accelerate its adoption. The latest report from Juniper Research indicated that the worldwide mobile payments are estimated to top $170 billion by 2015.

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.