Earlier today it was revealed that TELUS is in talks with Mobilicity to purchase its assets and AWS spectrum, which the new entrant spent $243 million in 2008 to acquire. Despite government pushback against excessive license transfers (they’re considering a change of rules to prevent the incumbents from purchasing an unfair amount of spectrum) and an abrogation against transfers themselves until early next year, Rogers, Telus and Bell are looking seriously at their options.

Rogers recently entered a deal with Shaw Communications to purchase its unused AWS spectrum, though currently it is an “option,” since the transfer can’t happen until 2014. Telus’ reported $350-400 million offer to Mobilicity is in the same vein: the extra subscribers and tower hardware would be a bonus, but the real deal is for the spectrum.

Wind and Mobilicity run their HSPA+ networks on what’s referred to as AWS, or Advanced Wireless Services frequencies, instituting 1710-1755 Mhz for the uplink (to the server) and 2110-2155 MHz for the downlink (from the server). It was this block of spectrum that the Canadian government auctioned off in 2008, raising over $4 billion in the process. Whereas it functioned to supply these upstart carriers the airspace they needed to deploy towers in Canada’s largest cities, the incumbents purchased as much AWS spectrum as they could to roll out future LTE networks.

It is in this situation we find ourselves today. According to Greg O’Brien, editor and publisher of popular industry journal Cartt.ca, spectrum is now the key play for all future telecom acquisitions; there’s a limited amount to go around, and the more a carrier has, the better guarded it is for the future.

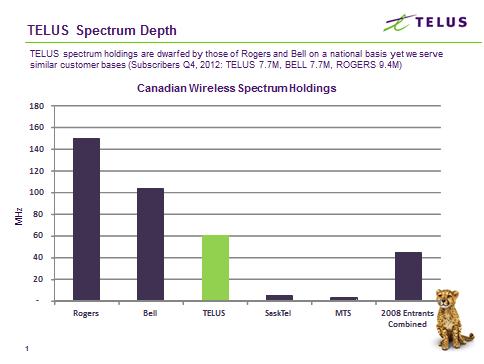

Telus has a greater need for spectrum than its incumbent peers, especially in central and eastern Canada where it is at a huge disadvantage in terms of capacity. LTE devices require at least 10Mhz of spectrum in a given market to ensure each channel has the requisite 5Mhz necessary to reach advertised uplink and downlink speeds. Telus only owns 10Mhz of AWS spectrum in high-density areas like Toronto, making Mobilicity (which also owns 10Mhz of AWS spectrum, albeit on a different block) a highly-desirable acquisition target.

Earlier this year, when the government of Canada announced its intentions to auction off its 700Mhz spectrum in November, Ted Woodhead, SVP of Federal Government and Regulatory Affairs at Telus, remarked on the company’s excellent spectral efficiency in a blog post titled Waiting for 700Mhz. In it he claims that “[Telus] serves roughly the same number of customers as our major competitors with significantly less spectrum available. This means we are more spectrally efficient than our competitors based on customers served versus spectrum available.”

While the chart and tally (see above) is accurate, fails to mention Bell’s and Rogers’ extensive supply of 2600 Mhz spectrum that has been used, in part, to take the burden off its strained AWS network in some parts of Canada. Rogers has launched several devices, such as the LG Optimus G and upcoming BlackBerry Q10, that take advantage of the full 10x10Mhz 2600Mhz band in most parts of the country, and will likely roll out more products as the network matures.

O’Brien also points out that while Mobilicity may be looking to unburden itself of its extensive financial difficulties, the reported talks with Telus are likely quite immature (they date back to February) and the new entrant would be advised to auction its valuable spectrum to the highest bidder once it is free to do so. Another potential bidder would be former Orascom CEO Naguib Sawiris, who is rumoured, along with Globalive owner Tony Lacavera, to be making a play for Wind Mobile Canada. Pairing the two companies’ AWS spectrum would give it enough bandwidth to compete with the incumbents in most major markets, and together could drum up enough new customers to support an investment in Apple’s iPhone.

Telus has not commented on its proposed plan to buy Mobilicity, but since the company is traded publicly, such intentions would have to be announced before any decisions could be made.

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.