A year ago, TCL had to dispel rumours it was skirting away from the BlackBerry brand after reports of a difficult 2017. Now, it says patience is slowly starting to pay off.

CES has become something of a state of the union for TCL and its various product categories, particularly as it relates to BlackBerry and media who care to ask about that brand. The Chinese manufacturer who makes the devices, coupled with others under the Alcatel brand, was painting a rosy picture at the show in Las Vegas.

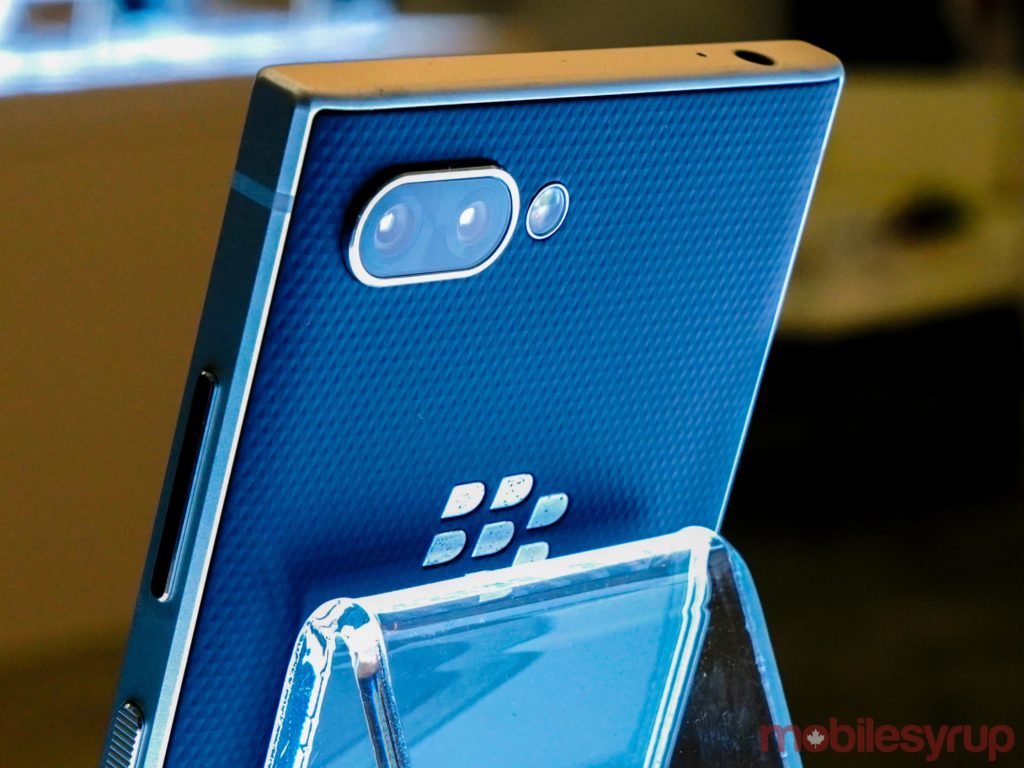

A rumour spurred by a contentious report last year put TCL on the defensive. This time, the outlook appears to be positive. No new devices were unveiled, so we’ll get that out of the way first. The Key2 and Key2 LE remain the current stalwarts, though something could be brewing for Mobile World Congress (MWC) coming up next month.

TCL’s only real major announcement, at least pertaining to BlackBerry, had nothing to do with Canada. U.S. carrier, Verizon, will carry the Key2 LE and market it to its enterprise and small business customers. To be clear, this is not a unique spec variant — it’s just made to work with its network. Verizon says it will roll it out in the coming weeks.

Despite the lack of anything new for Canada just yet, Francois Mahieu, general manager of BlackBerry Mobile for TCL, projected an optimistic tone for how the Key2 and Key2 LE were received in Canada.

“We connected more customers to BlackBerry globally and in Canada than the year before,” said Mahieu in an interview with MobileSyrup. “We’re seeing double-digit growth, but it’s a slow growth. We haven’t seen the brand hit 10 percent market share, so we are very humbled that this is going to take time.”

He describes Canada as a “traditional market” where there is “emotion for BlackBerry for a number of reasons.” Enterprise customers are coming back, he says, with banking and government sectors being key drivers.

“What’s interesting about Canada is there is a wide distribution of our product through the three main carriers, but we’re also starting to establish very strong relationships with retail partners, like Staples, Walmart and Best Buy,” he said. “One of the key things for (BlackBerry) is to get back as a business phone for Canadian enterprises and government organizations.”

He admits, however, that the business climate is also changing. BYOD, or bring your own device, is a real thing, where employees use the devices they choose wherever they work. Mahieu says it’s less of a factor for financial and government institutions. He cites one “very large” undisclosed Canadian bank having now rolled out more than 10,000 BlackBerry Key2 units to staff across North America.

Another unnamed bank offers its staff a catalogue of devices to choose from, which includes a few BlackBerry handsets. Mahieu wouldn’t budge when asked to identify the banks he was referring to.

Two provincial governments have also signed on to adopt BlackBerry phones for their staff, though again, who they were wasn’t revealed.

Despite the ode to business users, the majority of BlackBerry sales are coming from consumers. Mahieu says the ratio is 60 percent consumer to 40 percent business. The average age of a BlackBerry customer in the country is around 35-38 years of age, he adds.

“Half of the users on BlackBerry today are existing users, so they will be using a Classic, Passport or Priv already for years,” he says. “The other half obviously don’t come from BlackBerry, the majority of which are what we call ‘regretful abandoners.’”

Essentially, this latter group is made up mostly of defectors, users who had owned a BlackBerry at some point in the past but had since moved on to other platforms. Apple’s iOS was the favoured platform for this cohort, and according to TCL’s market research, the majority of the “regretful abandoners” are now beginning to return to BlackBerry.

No one at TCL disclosed any numbers or figures to prove this, so it’s hard to gauge how concrete the trend actually is. One point is that there’s one half clinging on to legacy devices who have not upgraded to something newer from the brand. The other point is that users are reportedly going back to the brand they knew before. With an average age that is barely, if even, in the millennial territory, it’s not clear how BlackBerry plans to woo consumers who don’t fall in those brackets.

So, why are users coming back in the first place?

“The number one reason why they moved to the iPhone was that they couldn’t find the same apps on a BlackBerry,” he said. “When we started with KEYone, less than 20 percent of people surveyed in Canada and the U.S. thought we were on Android. It took us two years to get to a point where 80 percent of Canadian customers and businesses knew that we were on Android.”

Then there are the Android updates. The KEYone took 13 months after launch to get to Oreo, a timeframe Mahieu admits took too long. While no promises were made to roll out major updates much faster, the monthly security updates have been steady.

Since relaunching the brand over two years, BlackBerry devices went from being sold in 10 countries to the current level of 50. Other markets are coming, though none were revealed in the interview.

It may take another 12 months, back in Las Vegas, before we truly see how many of those who abandoned BlackBerry ultimately flocked back to it — and whether they compelled others to do the same.

For everything else mobile from TCL at CES 2019, click here.

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.