BlackBerry recently announced its fiscal Q1 2016 results and ended the quarter with revenues of $658 million, along with an adjusted loss of $28 million. The company sold approximately 1.1 million smartphones at an average selling price of $240.

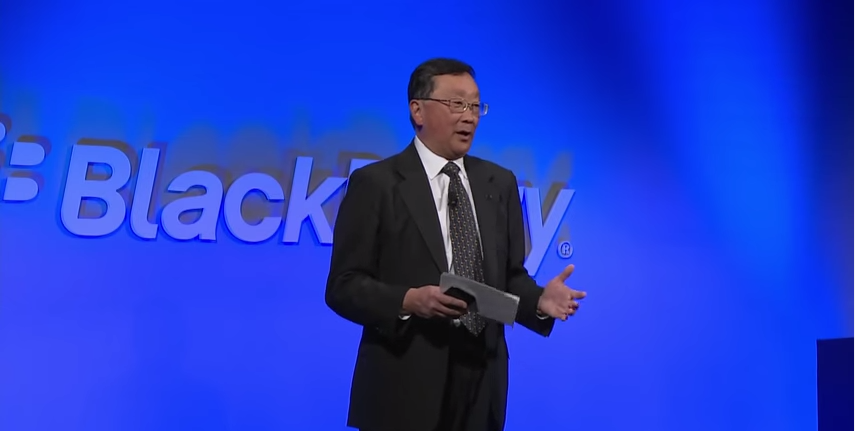

John Chen, BlackBerry’s CEO, appeared on CBC’s The Exchange with Amanda Lang, speaking openly about the future of the company. With a market cap of $4.1 billion, Chen noted that BlackBerry is on the path to recovery and is halfway through his turnaround strategy. While rumours of a sale or merger have circulated — both Samsung and Apple came up again last week — Chen stated, “I don’t have any intention to sell BlackBerry,” said Chen. “Not until the BlackBerry shareholder has good value reflecting truly what we have.”

However, if the turnaround plan is deemed a success and the shareholders are open to a transaction, “Then, if there is a potential proper suitor that would take care of our customers… I have a fiduciary responsibility to listen. But until then, there’s not point in listening.”

Chen says customers are coming back to use BlackBerry’s products, mainly for the security features, which he notes is a “turning point” for the company. With less that 1% market share, Chen says there are two reason why BlackBerry remains in the hardware business. One is practical and the other very emotional.

“The practical part is that we make the most secure handset. Everybody, all of our competitors, will give that to us. Governments around the world are still using BlackBerry handsets,” said Chen. “The emotional reason is, BlackBerry is iconic to the industry. We started this industry arguably… but I have to find a way to make money in the handset business.”

BlackBerry has been rumoured to be launching an Android phone in the coming months. The company recently formed a partnership that will make Android more secure in the enterprise.

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.