I was lying in bed, catching up on some news when the notifications began coming in. My good friend Adrian had dropped his iPhone 4S on some merciless pavement 36 hours before leaving on a cross-Canada tour. (His band, The Slocan Ramblers, are quite popular in Saskatchewan for some reason.) He needed a replacement, stat.

There are many ways to buy second-hand phones in Canada, and until recently they’ve all involved their fair share of risk. Craigslist and Kijiji are the Wild West, where you can neither vouch for the phone’s history, nor its longevity – used phone are at risk of being blacklisted by being added to the CWTA database for a variety of reasons. Some buyers are even sold counterfeit smartphones that resemble their genuine counterparts in form only.

Then there’s eBay, but you’re still at the whim of an unknown seller, or perhaps a slightly more reputable reseller where there’s still an inherent trust issue. Finally, forums like RedFlagDeals and Hardware Canucks, which have been around forever, have built a community of high-volume buyers and sellers, where it’s relatively safe to enter but, like Craigslist, you’re still likely dealing with a stranger.

For many tech experts, these avenues pose few problems: there’s the thrill of the chase, of finding the right deal exacted at the perfect time. I’ve used RedFlagDeals for years.

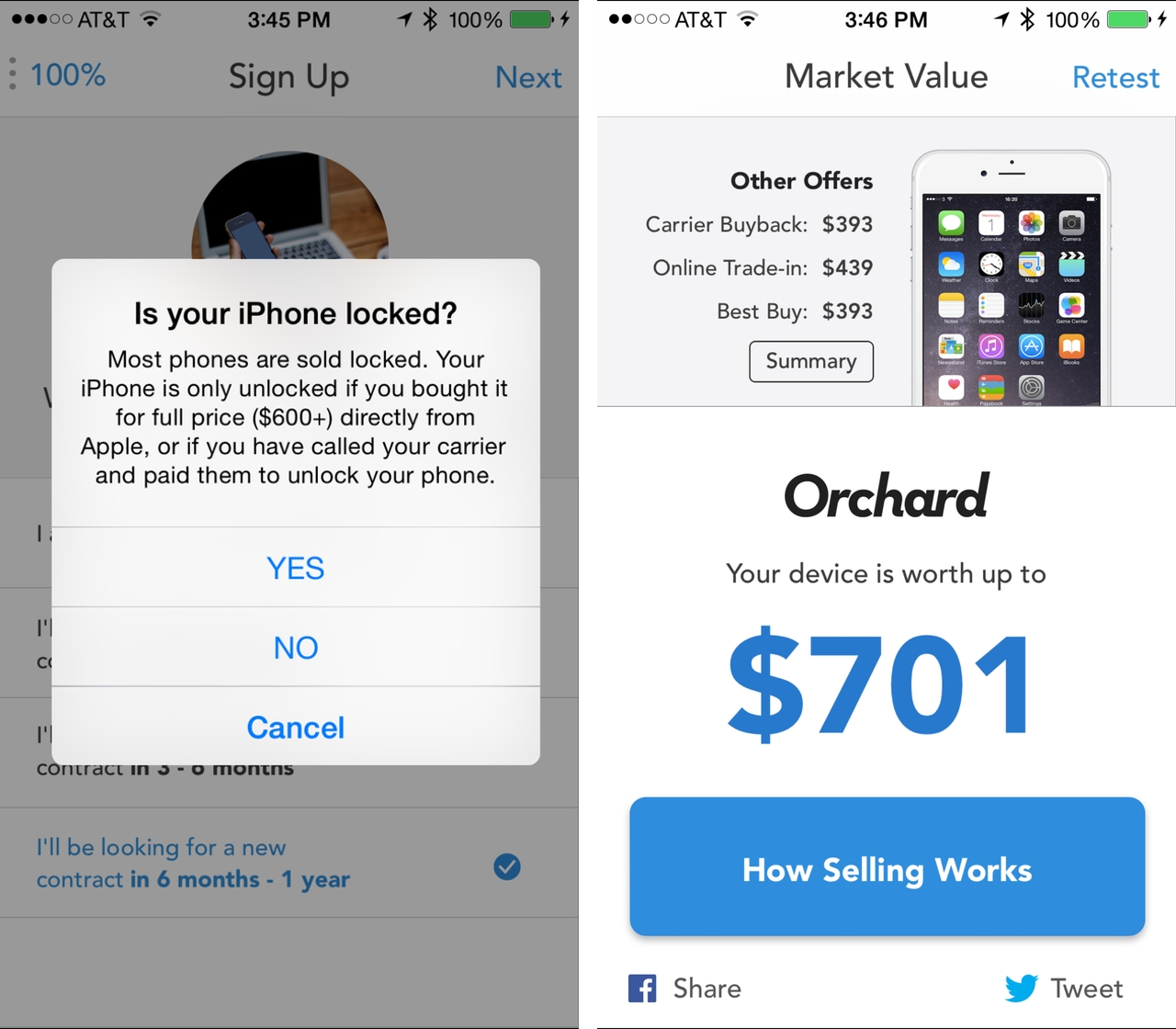

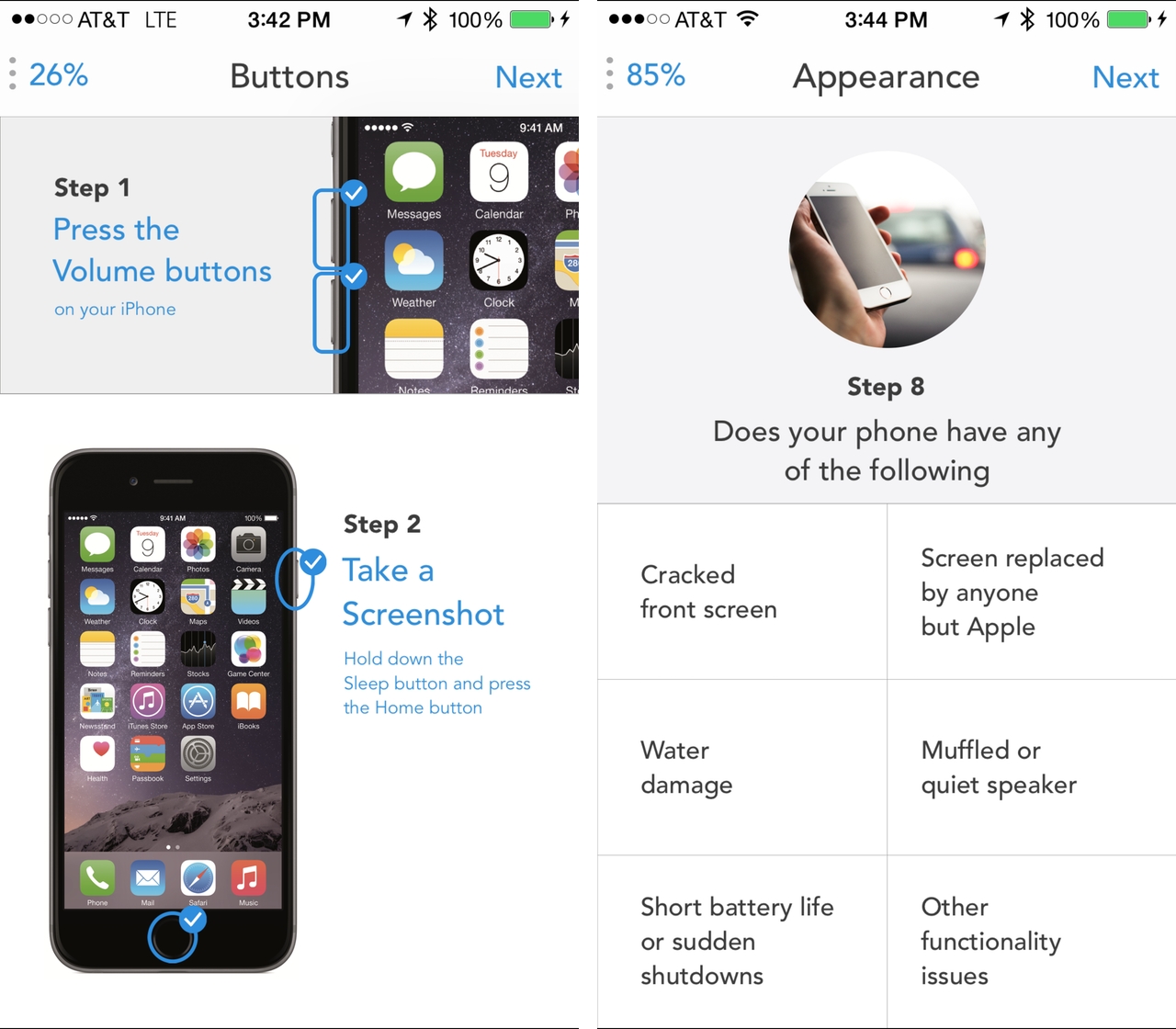

But Orchard is something different, and it’s arrived at the right time in a quickly-changing North American wireless market. Based out of Toronto, Orchard deals exclusively in used iPhones – for now – combining a thorough app-based diagnostic procedure with a curated element. After the sequence of testing is done, Orchard spits out a value for the device – well, three values – determined by the current state of the market.

“People just want to know what their phone is worth,” said Bruno Wong, co-founder and CEO of Orchard. “But we also take all the pain out of selling your iPhone.”

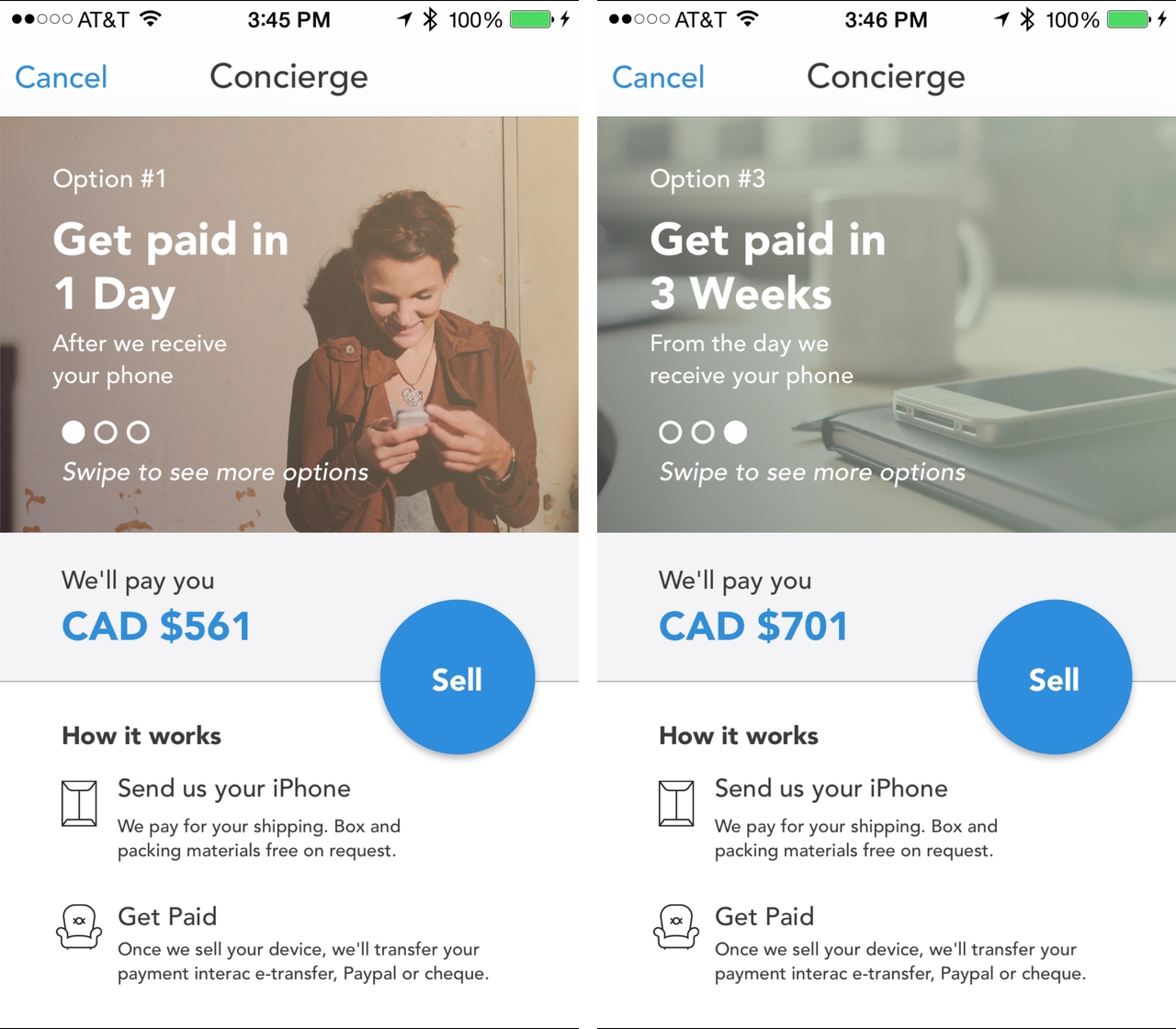

The company acts as consigner, sending a prepaid box to the seller. Once the company’s warehouse receives the unit, it is thoroughly tested, cleaned and, if necessary, given a low-level data wipe, before being listed on its webpage for resale. The company makes its money by scaling the amount it pays for devices based on how quickly the seller wants to get paid. “People quickly realize that there is untapped value in their iPhone. But most used phones are not sold,” says Wong.

The used smartphone market is a $14 billion annual market in North America, and over 80% of devices are, once purchased, not resold. For Orchard, then, it isn’t a matter of taking business away from another service like Craigslist. “We are actually growing the market,” Wong continues. “Most people have no idea where to start with selling their phones.”

Anecdotally, I’ve spoken with dozens of people whose working iPhones stay in drawers when they upgrade. Many of them could be sold, even for parts, at prices high enough to reinforce Apple’s resale dominance.

Traditionally, the iPhone holds its value much longer than devices from competitors like Samsung. According to a 2013 study by Cowen and Company, the iPhone sells for, on average, $128 more than its generational counterpart on Android, and its value decline is much slower. It was that untapped market, and revenue potential, that interested Wong and his two cofounders, Alex Sebastian and Hamza Javed, enough to start a company around buying and selling phones. And while iPhones won’t forever be Orchard’s focus, the company’s $1 million annual run rate speaks to the momentum gained since its launch in 2014.

This week, Orchard expands to the U.S., coming off a major funding raise from MLA48, looking to tap into a market that, while slightly more saturated than that of Canada, is over 10 times larger. “When we first started (back in 2012), we thought of being Craigslist 2.0, a cleaner marketplace for people to buy and sell phones. But we quickly realized that wasn’t enough.” Orchard’s iteration comes from years of trial and error: “People need to be led through the gauntlet to buy or sell phones, because it’s a scary process with a lot of unknowns.”

Orchard has been growing 20% month over month, and has picked up over 125% in the last two months alone. Most of that growth is word of mouth, too: the company hasn’t spent any money on marketing. Through social networks like Twitter and Facebook, the word Orchard has begun replacing the words Craigslist and Kijiji, since it is a more trusted source of used iPhones. Not only are the products thoroughly tested, but Orchard acts as the middleman most people wish would be present at that sketchy strip mall or subway station.

The company’s growth also comes at a time when people are learning about the virtues of BYOD, or bring-your-own-device. Canadian carriers offer discounts of $20 per month on most price plans aren’t bundled with a smartphone purchase, so a good-condition used iPhone is an extremely hot commodity in this market. “There are a lot of benefits to buying a phone outright over signing a contract,” says Wong, particularly emphasizing unlocked devices that can freely be taken from carrier to carrier, or used with a local SIM card while roaming.

Orchard is also playing the long game. Along the course of facilitating someone’s phone sale or purchase, the company learns a lot about its customers: whether they’re in a contract and, if so, for how much longer; whether they’re interested in a tablet or wearable; whether they’re happy with their service provider; where they tend to buy their accessories. Eventually, Orchard wants to be the trusted hub for every aspect of a phone’s life cycle, not just when someone wants something new, or get rid of something old.

“We see ourself as the service that compliments phone ownership,” says Wong, pointing to a low-friction phone unlocking service that is growing by 60% month-over-month.

Considering most phone buyers don’t necessarily trust their carriers when it comes to service and repairs, Wong thinks there’s plenty of potential for disruption there, too.

Orchard isn’t alone in wanting to disrupt the used phone market – established players like Swappa and Gazelle are well-known in the U.S. for example – but its vision is wider, and its execution appears tighter.

“Everyone out there, they’re version 1.0. We’re 2.0.”

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.