BlackBerry has “narrowed its list of potential bidders” and reportedly pushing for a quick sale – potentially as early as November. Rumours around the web are that private equity firm Fairfax Financial Holdings, which owns a 10% stake in the business, is interested in scooping up BlackBerry. In addition, Microsoft is ‘keeping an eye’ on what the Waterloo-based manufacturer is up to.

For several years many investors have been pushing BlackBerry to be split up into several parts: network, device and patents. Unfortunately, something of this nature just might happen.

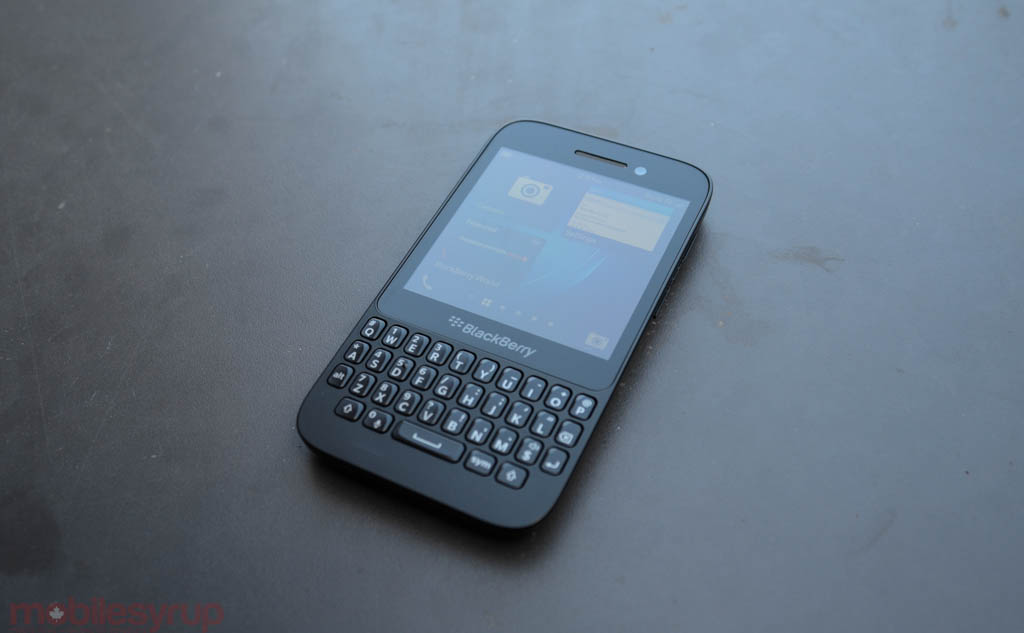

According to a report in Reuters, several unknown bidders have signed confidentiality agreements and are looking into ways to break the company up into two parts – operating system (BlackBerry 10 and the network assets) and its vast collection of patents, specifically highlighting its keyboard. Possibly vanishing from the plan is its hardware production. However, there is a glimmer of hope as the report states there might be interest from “a Canadian pension fund to team up with an investor to buy the whole company, which is currently worth a little more than $5 billion.”

Reuters notes that “According to analysts, BlackBerry’s assets include a shrinking, yet well-regarded services business that powers its security-focused messaging system, worth $3 billion to $4.5 billion; a collection of patents that could be worth $2 billion to $3 billion; and $3.1 billion in cash and investments. Even at a conservative estimate, that is more than the company’s $5.4 billion market value. Analysts said the smartphones that bear its name have little or no value and it might cost $2 billion to shut the unit that makes them.”

BlackBerry clearly declined to comment the speculation. In the near future, BlackBerry is focussed on delivering BBM to iPhone and Android users, plus planning to launch the 5-inch BlackBerry Z30 in the coming weeks.

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.