I thought I had read it wrong. Galaxy S5 Neo? What does that even mean, and why, after nearly two years, would Samsung release an almost identical version of its old flagship smartphone?

The story of the Galaxy S5 Neo is the story of a new reality for Canadians, where a weak dollar converges with the kind of component longevity the PC market began seeing eight or so years ago. With smartphone usage approaching nearly 90 percent of most carriers’ postpaid customer base, those companies need to outfit their shelves with a variety of devices at every price point.

The most notable example of this trend is Apple’s consistent re-framing of its aging handsets for new demographics. This year, the 6s and 6s Plus replaced the iPhone 6 and 6 Plus as the company’s highlight products, but instead of being decommissioned, the phones received a lower price tag and a second life. Similarly, the iPhone 5s became the company’s ostensible entry-level phone.

This strategy is now being imitated by Samsung, the next-biggest smartphone vendor in Canada. Having released the Galaxy S6 and S6 edge, the company’s plastic derivatives, 2014’s Galaxy S5 and 2013’s Galaxy S4, got pushed down the chain, the latter selling for free at many carriers of record.

As the Canadian dollar continues its weak showing against the Greenback, this trend is likely to continue. High-end products act as aspirational markers for the entire product line, similar to the way a car brand’s premium lineup shines a light on its more conventional sedans.

With the release of the Samsung Galaxy S5 Neo, we’ve reached peak recycling. What amounts to a regular Galaxy S5 with its Qualcomm-based chip replaced with one of Samsung’s own Exynos processors, allows carriers to position the device as both a new device and one that is comfortably familiar. And when one looks at the spec sheet — a 5.1-inch HD display, an octa-core processor, a 16 megapixel camera and waterproofing — it somehow survives the barrage of scrutiny often imposed on a new smartphone.

Samsung gets away with this recycling because the market has reached a point where components — especially the important, high-margin modules like the processor, the display and camera — are cheaper to manufacture, and don’t become obsolete as quickly as they did in the past. In many cases, devices like the Galaxy S5, and its Exynos-equipped Neo counterpart, are better value propositions for many customers than buying a brand new product aimed at the mid-range market, like the Galaxy A5, which was also recently released in this country.

But those two markets are quickly converging. We’re seeing products like the Alcatel OneTouch Idol 3, Moto X Play and HTC One A9, positioned at three price points and audiences, with nearly identical internals (the Snapdragon 615 and 617 are largely differentiated by LTE capabilities). Indeed, the chasm at the top of the charts, where the high-end iPhones and Galaxies beget premiums of $200 to $300 on contract versus their counterparts from LG, Huawei, Sony and others, is becoming even more stark as the mid-range market becomes more diffuse. It’s difficult to find a bad smartphone anymore.

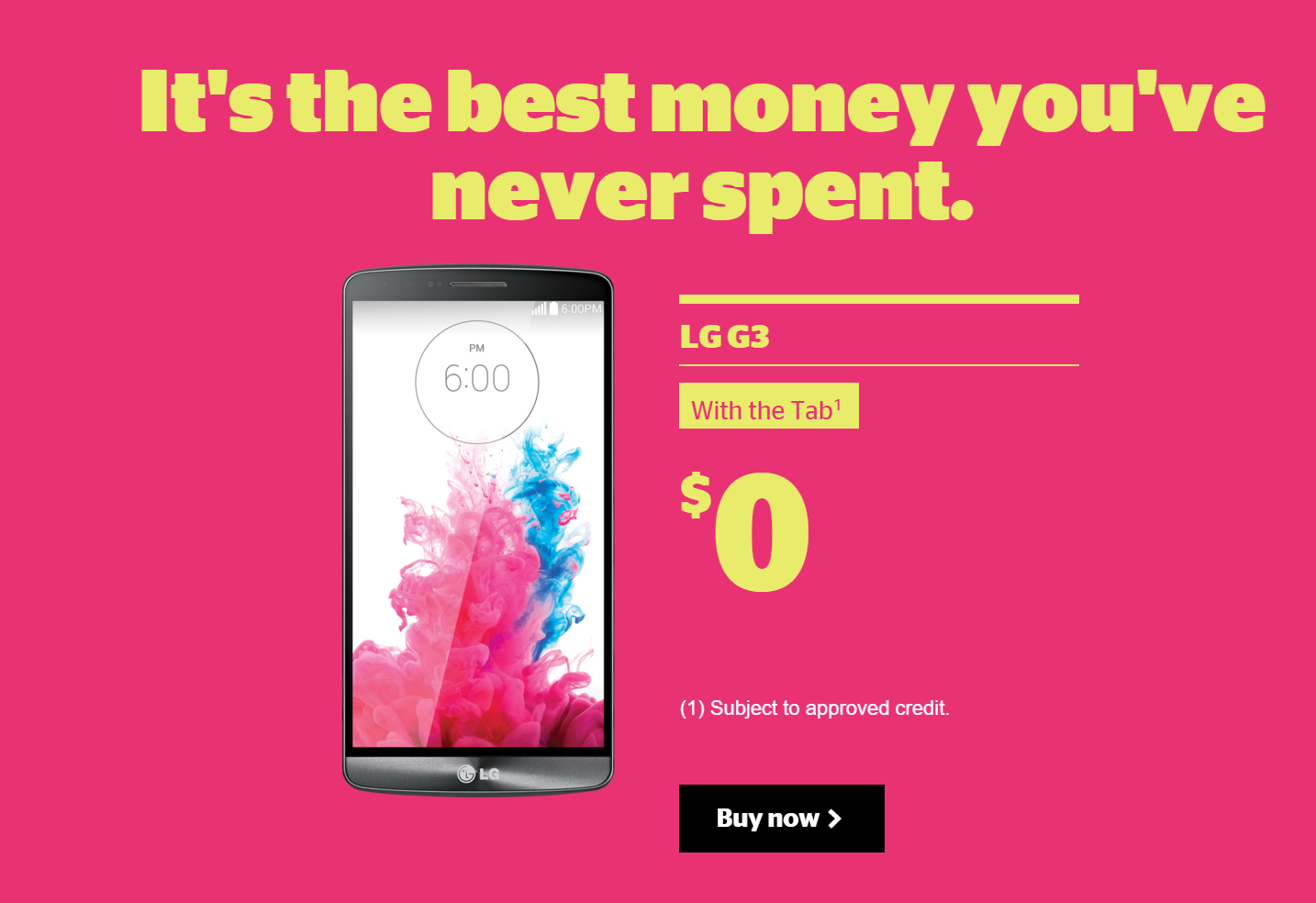

The narrative is even further complicated by the positioning of Canada’s flanker brands like Fido, Koodo and Virgin Mobile. While it’s easy to take for granted the Big Three carriers, Rogers, Bell and Telus, will stock offer practically every expensive smartphone, their sub-brands must be more careful about how they position themselves. If you live in a big Canadian city, you’re unlikely to have missed the enormous LG G3 renders associated with Koodo’s and Fido’s latest marketing campaigns, the phone’s friendly dual-tone face beckoning potential customers with, in Koodo’s case, “the best money you’ve never spent.”

When the G4 was unveiled earlier this year, it seemed likely that its predecessor would be quickly whisked away from the maddening crowd, especially since the company was pursuing a strategy of recreating its flagships in smaller form factors in devices like the LG G4 Vigor. But LG caught at the right time the trend of re-purposing aging devices, lowering the phone’s MSRP from over $700 to around $400, and enticing carriers to offer it for free on a two-year contract. And while it’s unlikely we’ll ever know the degree to which the price drop spiked sales, that LG’s near-dead flagship was resurrected as what amounts to a mid-range phone speaks to the market’s need to fill such empty spaces, and the resilience of the components found inside Android devices released over the past 18 months.

Indeed, 2015 will be seen as the year the smartphone market turned towards the middle. Whether it’s selling modified versions of aging products as new again, as with the Galaxy S5 Neo, or giving them new life, as with the LG G3, smartphones are spending a lot longer on store shelves. That, and the maturity of the platforms in general, is making it increasingly difficult for companies like Apple and Samsung to convince users to spend upwards of $400 to $600 up front for an on-contract phone.

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.