Canadians are pushing past the duopoly of Google and Facebook, according to measurement firm comScore’s 2018 Global Digital Future in Focus report.

The report called growth for ‘non-duopoly’ properties “encouraging,” with total minutes for the top 100 properties, excluding Google sites and Facebook, growing steadily.

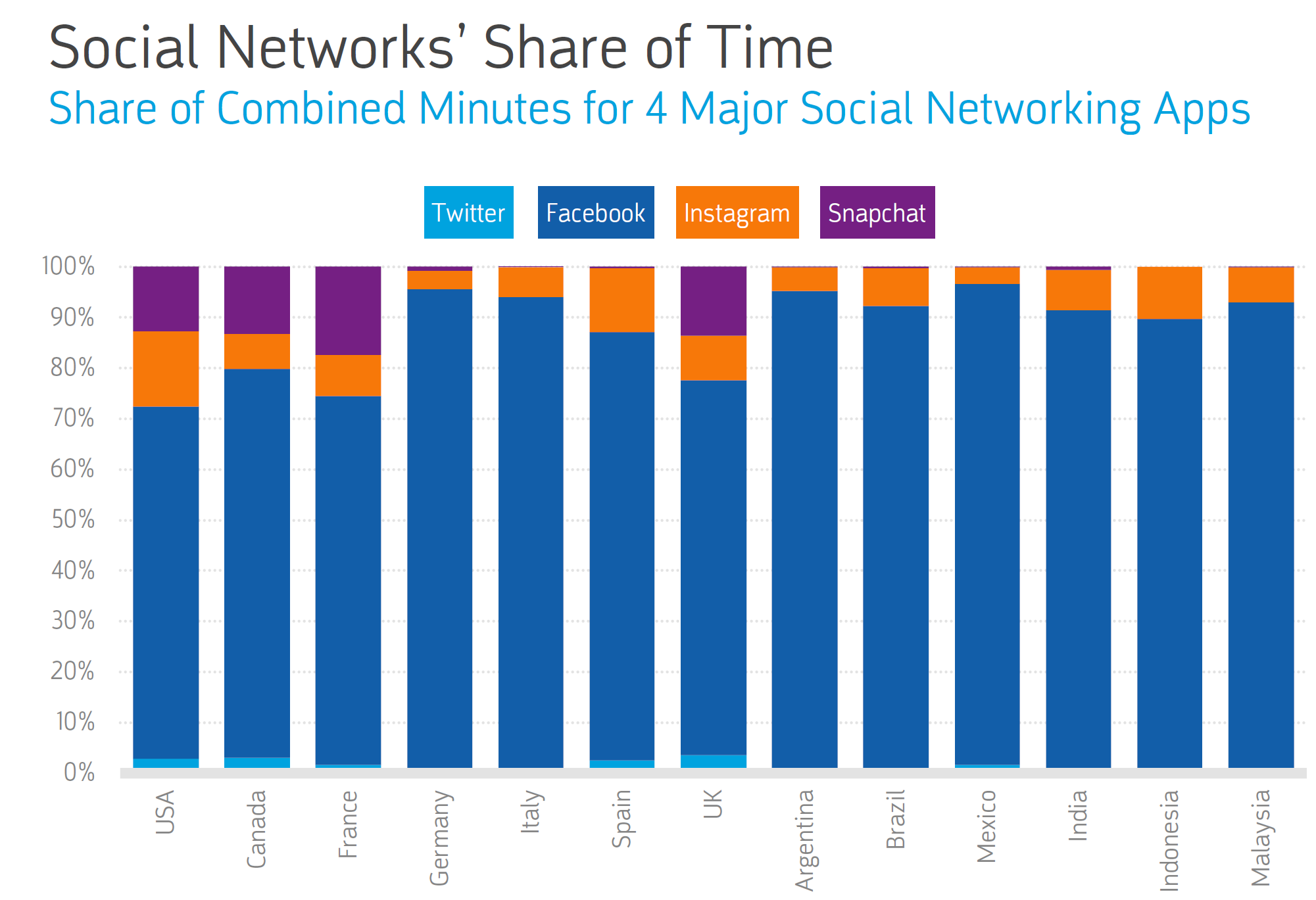

comScore’s report uses multi-platform data from 13 countries: the U.S.A., Canada, France, Germany, Italy, Spain, UK, Argentina, Brazil, Mexico, India, Indonesia and Malaysia.

Among the non-duopoly presences breaking up Facebook and Google’s dominance is Snapchat, which has lately experienced its fair share of struggles, but is evidently still hanging on in popularity with a younger audience.

In examining the distribution of minutes between four popular social networking apps — Twitter, Facebook, Instagram and Snapchat — the ephemeral photo sharing app came in a distant second to Facebook, but ahead of Facebook-owned competitor Instagram.

This is especially noteworthy since Instagram has adopted many of Snapchat’s features over the past year or so in an attempt to gain market share, but still hasn’t quite captured Snapchat’s allure, at least in Canada.

Snapchat also became a new entry into the top 5 app charts for the U.S.A. and the U.K., while in Canada the top five apps are Facebook, FB Messenger, YouTube, Google Search and Google Maps.

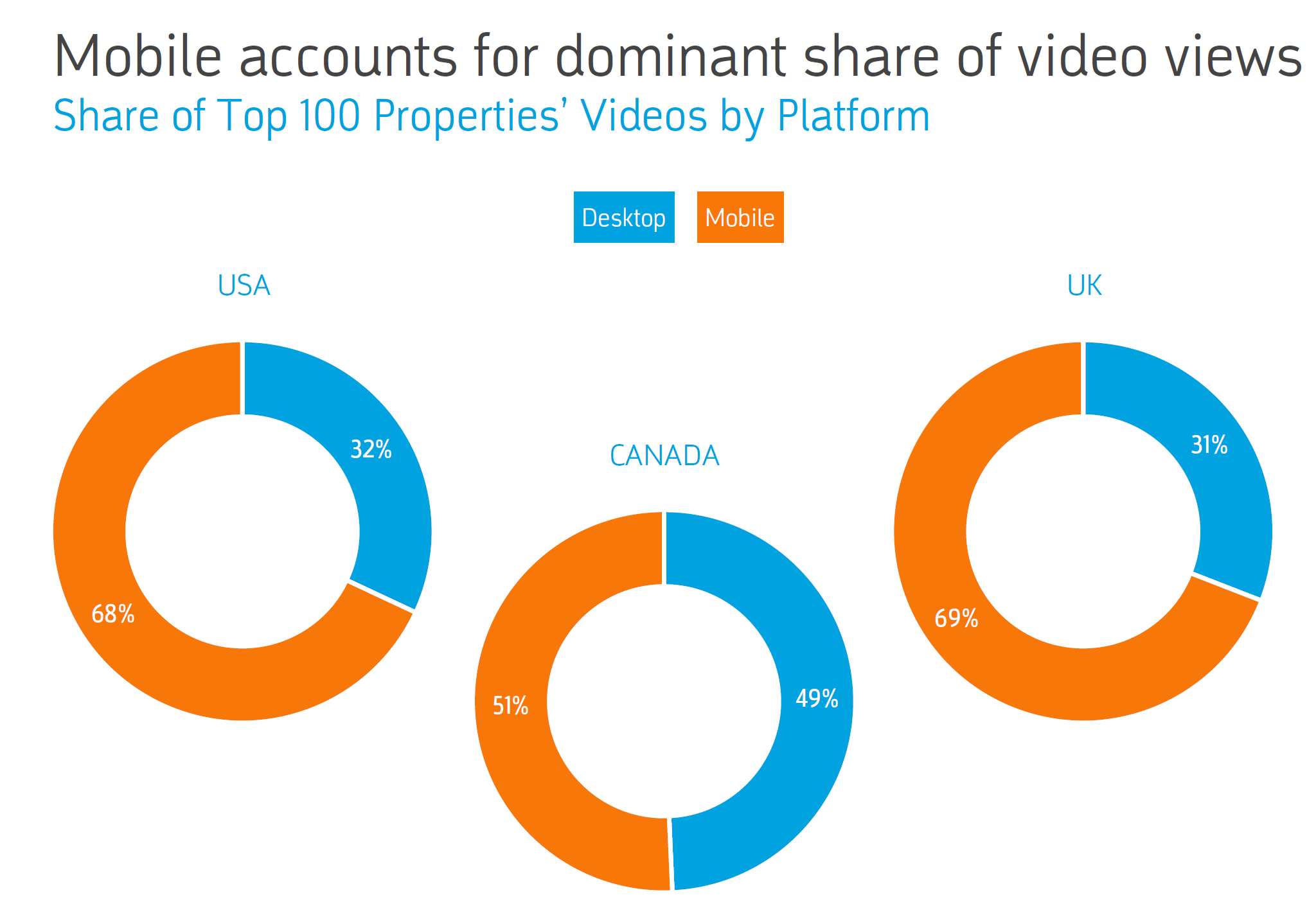

Another key trend identified by the comScore report is the rise of mobile-first and mobile-only use among the countries it studied. In that respect, Canada diverged from many of the other countries, with desktop use still edging out mobile by about 20 percent as of December 2017.

Additionally, while in the U.S.A and the U.K. mobile accounts for the large majority of video views for the top 100 properties (again, as of December 2017), in Canada the mobile just barely edges out desktop at 51 percent.

There’s also a surprising amount of tablet use in Canada. It has the largest share of total digital minutes spent on tablets among the countries studied, at 15 percent.

comScore’s insights come through its Mobile Metrix product, which provides agencies and publishers with analytics and measurements regarding mobile audiences. The firm did not disclose the details of how it measures its insights, but MobileSyrup has reached out and will update this article if it divulges further information.

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.