Finance and payments have not traditionally been considered bastions of technological innovation, and the recent announcement of Apple Pay was predicated on the idea that the consumer giant was required to provide a solution traditional payment companies couldn’t.

But MasterCard has recently demonstrated that it is not a traditional breed of payment company through a variety of initiatives that use 21st century tech to disrupt a 20th century infrastructure. At the recent MasterCard N>xt Developer Challenge, I had the opportunity to speak with Garry Lyons, MasterCard’s Chief Innovation Officer, and leader of the MasterCard Labs initiative, about the company’s commitment to mobile payments innovation and how that will play out for Canadians.

What does it mean to be a Chief Innovation Officer? For a lot of companies you would expect that to be PR, but you obviously come from a development background.

In simple terms, we’ve been successful for four reasons: the quality of our products, our people, our processes, and our infrastructure. That’s really what’s made us relevant in the payments ecosystem.

If you look at our processes and our infrastructure, there’s an awful lot of rigour. And there needs to be rigour because we process trillions of dollars of transactions across 200 countries in 150 currencies. But the problem with rigour – and we absolutely have to have it – is that it doesn’t allow you to take risks. So you need to have an alternate approach that’s complimentary to what you’re doing inside the core business, and that’s what we’ve created at MasterCard Labs.

So that’s a longwinded way of saying that my role is to look at our future from a fresh perspective, see what’s happening in consumer and business technological trends, and how they’re going to impact commerce and how they’re going to impact our business. The second thing is creating new products and solutions for MasterCard to bring to our customers, and then thirdly to further development of a culture of innovation right across the company.

And that’s your tech R&D team you talked about earlier, right? How do they fit in?

We affectionately refer to them as the freaks and the geeks. They’re the guys who build prototypes, and they have a strong appreciation of technology as an enabler. Technology is sort of a means to an end – you have to be solving a real problem or creating an efficiency otherwise you won’t succeed. If you’re not doing something better than what already exists, consumers won’t adopt it, because changing behaviour is hard. Using a piece of plastic is an awesome experience – it just works everywhere. So we need to make sure that as technology evolves, we focus on creating better experiences for customers that makes their lives easier – whether that’s in developed markets, by making shopping easier, or in developing markets, where we’re talking about financial inclusion and giving people access to electronic payments.

So the technology team is very focused on building prototypes and piloting new solutions. The key thing with them is that about 80% of them know nothing about payments, and that’s by design, because if you know too much about the domain –

– you start shutting down options.

Exactly. We’re actually trying to look at the future from a fresh perspective, and we believe for that people need to think differently, because pretty much every established company faces the challenge of going from the lab to the market. You’ve got rigour, you’ve got cost, you’ve got business cases – so what we’ve done is actually created a process which allows us to act like a venture capitalist inside of a big company, and we’ve created independent startups that go to market independently of the core business while still taking advantage of the core business.

They have their own CEO, their own tech team, their own sales and marketing team, their own support team, exactly as if they’re their own startup, using lean startup methodology. If successful, we fold them into the core business, or maybe we kill them or re-incubate them to get them a second round of funding or potentially we spin them off and take advantage of the fact that we created them.

Obviously as a Canadian I don’t need to be taught how to use my debit card – my plastic – but as a Canadian who has travelled to the U.S., I don’t understand why my debit card doesn’t work for transactions there. Because we’ve had Interac for debit payments, and the U.S. eventually had to get Visa debit. So how much of this is technology actually making things better and how much of this is changing infrastructure? Because using Google Glass to buy a Coke bottle [which was demoed at the N>XT event, ed.] doesn’t seem practically useful.

“Do I want to have a different app and a different wallet for every single commerce engagement? The answer is no I don’t.”

You’re right, but using my smartwatch to pay in a restaurant, or using my smartphone, is actually solving a problem, because it solves having to wait 15 minutes before you leave, which is also bad for the merchant. But you’re absolutely right, innovation is not all about innovation at the edge. So we’re creating certain innovations that leverage the infrastructure that already exists, and that gives us an opportunity to scale.

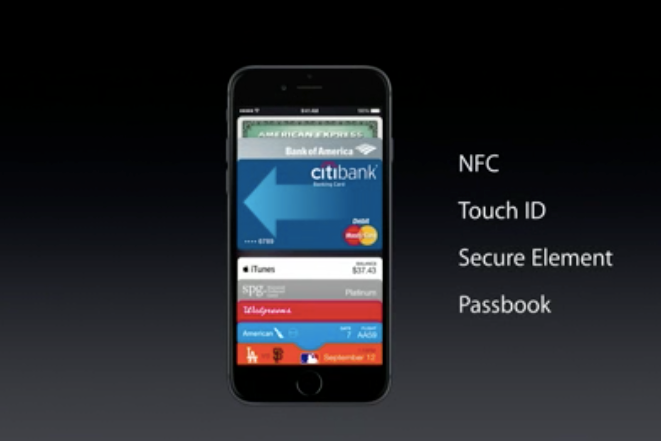

But we are innovating everywhere. A great example of a recent innovation that has come to life is MDES, MasterCard’s digital enablement service. And that’s the tokenization so that when you actually register your payment details in an iPhone 6 or 6 Plus for Apple Pay, your real payment details are not stored in secure element, it’s a token. So we innovate on the infrastructure and continue to build that out, adding many, many new features, but equally we innovate by creating broader solutions that deliver value, typically before, during, or after the transaction.

When I pay with a card or I pay with cash, I’m using one wallet with those things in it. I don’t think technologically customers are going to be willing to deal with a different payment app or system for every scenario. You said in your keynote that Canada would be ready for Apple Pay infrastructurally when it comes, but when it comes to the logistics of all these companies, how are you looking to work together with them, and how do you think it needs to happen to create that technological ubiquity?

I think you’ve hit the nail on the head. Do I want to have a different app and a different wallet for every single commerce engagement, whether that’s in a coffee shop or a restaurant or a movie theatre or a gas station? The answer is no I don’t. So what we want to do is ensure that the infrastructure is there and the utility is provided by a smaller number of apps.

So utility like our MDES tokenization, which supports all of the major card issuers, so if you have a CityBank card or a Bank of America card, it just works. And then in terms of some of the applications I showed today, where I’m able to get a beer delivered to my feet at Yankee Stadium, or order a coffee before I get there, that’s all the one app – so it’s a multi merchant experience. Again, we’re not necessarily saying that we want to role that out at scale, but we’re actually testing scenarios to see if we can provide better experiences to customers. It could be that this capability is integrated into my bank’s mobile banking application, so that it extends to provide commerce – who knows what the future’s going to look like?

But my view is that technology’s role is to make people’s lives easier and you need to remember it’s not just about the payment. We will continue to make payments safer, simpler, and smarter, but we will continue to look at how technology can make people’s lives easier. Because consumers don’t want to think about the payment, they think about what they’re trying to do with the payment – they need to get a cab to get to work, they need to pay for groceries. Yes, payment is absolutely necessary, but we want to focus on making it easy for the end user, too.

I think the reason for the lack of engagement with mobile payments isn’t because people are confused by or not aware of the technology, but because there hasn’t been one clear winner. But I also think the second component is security concerns. To what extent can consumers trust that mobile payment solutions, which can plug into every app and website with one line of code, will actually be secure, when they’ve been raised generationally to know that the secure places to do monetary exchanges are in actual physical locations? When commerce now rests in your phone, how do they have that same level of trust?

Having brands that are inherently trusted to provide secure solutions is a great starting point. I think education is a strong part of it. Does this consumer really care about something like tokenization? No. But do they care about the fact that their real card details are not stored on the mobile device? Yes.

I think the other thing is, when you actually make a payment with Apple Pay, a couple of things are at play. The first thing is that its typically a contactless form of payment at point of sale, or I can do it in an app. In the contactless example, it’s the exact same as tapping my card – it uses a chip and PIN protocol called EMV which secures the transaction – and there’s an additional level of security with Apple Pay, Touch ID uses my fingerprint to authenticate.

There’s a lot of complexity there with things like tokenization and Touch ID, but what we’re trying to do is take all the complexity and deliver it in a package that brings value to the consumer in an easy way. Moving money today securely across 210 countries in 150 currencies is complex, and what we do is take that complexity and hide it from the user.

Are you happy if MasterCard isn’t the front-facing component but everything still works? If Apple gets all the credit for solving payments but you did all the work are you okay with that?

In terms of making a payment today, when I’m making a payment with Apple Pay I’m aware that I’m using my MasterCard. So it’s a partnership between Apple and MasterCard to fascilitate users who have and Apple 6 or 6 Plus device and a MasterCard to be able to make a payment easily and securely.

And it is truly a partnership, because when I walk into a store like Tim Hortons, Tim Hortons accepts PayPass. So then I can just use my iPhone to do that. It’s not that the Tim Hortons is suddenly saying it accepts Apple Pay, it’s a partnership between the two.

I think with mobile there’s a rush for all these companies to get their own app, and I think that has forced customers to think in a new way about these companies, and to consider the payment, when all they want is their MasterCard to work.

And that’s fundamental to our core business, which is about enabling the 2 billion MasterCards that exist in the 38 million merchant locations around the world. But we also recognize this as an opportunity to provide even greater value by opening up our services to allow others to do that. Whether that’s going deeper into the purchase experience or not, who knows? The reality is, first and foremost we want to provide our customers the acceptance promise of MasterCard around the world, but we can’t be sitting around on plastic as if plastic is going to be around forever, because not only do we think about a world beyond cash, we ultimately think there’s going to be a world without plastic.

A card provides a great experience, but technology allows you to do even more. When you use a card today it’s great, it’s fast, it’s simple. But nobody knows I’m in that store, and who I am until I make a purchase. So merging the technology in the store, you can enhance the experience benefit before, during, and after the transaction.