A recent survey from comScore suggested that 12.3% of Canadian mobile subscribers (24.5 million) have accessed banking, credit card, insurance or brokerage account information from their device. They didn’t give a breakdown of how many were for each category but TD Canada Trust stepped up today with their own poll.

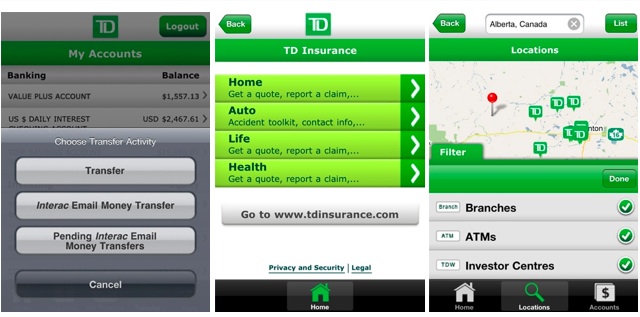

The “Everyday Banking Poll” reached out to 1,000 Canadians between August 3rd – 9th and found that only 8% actually use mobile banking. This consists of checking account balances, paying bills, transferring funds. What are the main reasons that hold Canadians back from using mobile banking? Well, top of the list is a screaming 66% who say it’s because they don’t have a smartphone (8.8 million Canadians now own a Smartphone). Other reasons are that those surveyed believe it’s unsafe (14%) or too expensive (12%).

Raymond Chun, SVP at TD Canada Trust, said “Mobile banking is still in its infancy, but its popularity has grown exponentially as more and more Canadians switch to smartphones”.

Source: CNW

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.