Facebook’s acquisition of WhatsApp is a big deal – the results of which will play out over many years. While media everywhere have been quick to opine, we wanted to get a different take. So we reached out to Jeff McDowell, a former Desire2Learn and BlackBerry exec, to explain the executive mindset behind a deal of this size. Enjoy!

______

Much about Facebook’s WhatsApp acquisition is being debated. Many (including myself) initially said “this is crazy,” but now you’re seeing the majority of articles defending the transaction. I suspect some of those people are reacting to the fact they remembered they own Facebook in their stock portfolio, while others are providing a decent, yet incomplete view of the decision.

I won’t argue for a second that in order to remain relevant Facebook has to have a highly engaging messaging application. They already own photos, timelines, many-to-many interactions, and social profiles. The only remaining highly relevant component of one’s social toolbox is rich peer-to-peer messaging. SMS made peer-to-peer texting ubiquitous, and BBM showed the world how addictive an evolved chat experience could be with low latency communication and delivery/read confirmations. Sigh, I’m getting awfully reflective while writing this…but that’s another story. Something I will debate, however, is how tightly an IM needs to be integrated into a social network. More on that later.

So with messaging identified as an imperative, a company then turns to its Chief Strategist (likely the CEO, and in Facebook’s case, most definitely Mark Zuckerberg) and asks “what is the best way of achieving this?” At this point, the classic question comes up: build or buy. And while the strategy in itself is binary, the analysis on driving to a conclusion is ridiculously complex (here’s some useful reference material if you’re interested in learning more).

Shareholders may still have trouble with Facebook spending $19B to make $1B in 3 years.

But in the analysis phase there is one tenet of business that to me often gets forgotten or minimized in acquisitions, especially when momentum of a competitor(s) weighs heavily on the decision. Corporations are in place to maximize shareholder value, and shareholders will judge the use of their capital dollars. Right now analysts are crunching the numbers and I believe they are going to come to some pretty interesting conclusions about what it would take to score this as a “good acquisition.”

I’m not a professional analyst by any means, but I have made some simple observations. Business Insider gave it a thumbs-up based upon relative per-user price compared to other social networks. Compared to others, it’s relatively low. With both Twitter and LinkedIn coming in around $80 per user, they say that $45 for a WhatsApp user is a bargain. But there’s a major flaw in this reasoning, and that is the assumption that Facebook can monetize these users at a much higher rate than WhatsApp’s current plan calls for. Twitter’s latest quarterly earnings showed revenue per user of around $3 per quarter and currently Whatsapp’s plans are to make $1 per year. Zuck is confident that WhatsApp will reach 1 billion users “in no time”, which at its current pace would be in about 1.5 years. That’s nice, but assuming they convert every single user into the current $1 per year plan, they will have revenue of $1B per year in about 3 years (you get a year for free). Shareholders may still have trouble with Facebook spending $19B to make $1B in 3 years. So there has to be another plan.

In order to make this a bit more lucrative, Facebook would have to actually get a large portion of the non-Facebook using WhatsApp community to join the much higher returning Facebook platform. The BI article I quoted states that a Facebook user is worth $175. So in order to support the price paid for WhatsApp they would have to convert 110M new users over to Facebook in order for the deal to make sense (110M x $175 per user = ~$19M). Are they certain that the potential user base is there? Would they have the same engagement as the current Facebook base or would they dilute revenue per user? Do they even have a plan to convert them? These are questions executives at Facebook must have answers for.

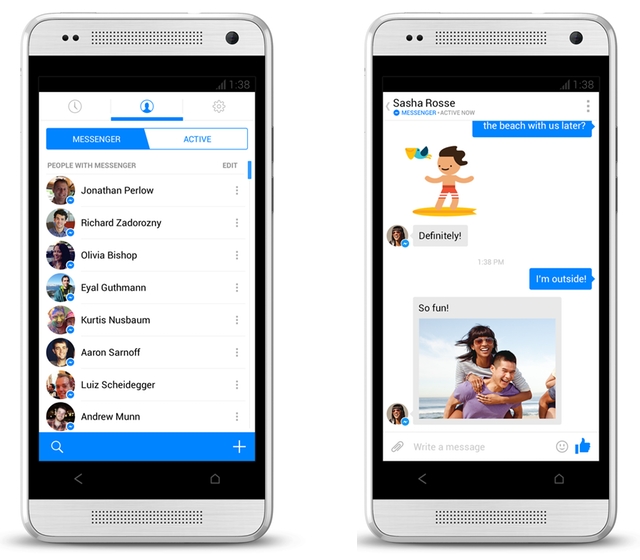

There is a correlating issue here with the other route to achieving the objective of a ubiquitous peer-to-peer messaging platform (remember: build or buy). Facebook Messenger hasn’t exactly failed: the app has over 300M users, which is bigger than Twitter. But momentum around growth has stopped and there is concern it has lost the ability to become that ubiquitous messaging platform.

But what have they really invested in it? Maybe $50M in development? Maybe $1M in awareness? I suspect those numbers are fairly generous. What if Zuck turned to Cheryl and Mike at the foosball table and said, “Hey, what if we allocated $1B to the Facebook Messenger? Think we can make it cool?” At the end of the day, Facebook is the largest single aggregator of humans on the planet. Surely they have the ability to build something that got them chatting with each other, no? Facebook Camera failed to replace Instagram, but I believe that’s partially because Facebook shot it in the head with the Instagram purchase before it even had the chance.

Facebook’s mission is to give people the power to share and make the world more open and connected. As a shareholder, I believe in this mission. I would expect the ability to chat with my friends one on one is included in that mission. I wouldn’t expect them to have to completely ignore their own innovative development capabilities and acquire this functionality for a king’s ransom. I’m not totally sure what $1B gets you in a development effort, but it’s probably more than Facebook has spent on their entire platform to date. And it’s 19 times less than what they paid for WhatsApp.

But what if Google bought them? My hypothesis remains that IM is its own use case.

The other strategic area I haven’t talked about is using acquisition as a defensive move. Obviously this has to be taken into consideration, but I have a different take on this as well, a take that might seem contrarian to what you’ve seen, and one I eluded to earlier. I just don’t see an IM platform directly competitive to a social network. While inherently social, it serves a different purpose. A social network is a digital soap box, a way the average Joe/Joanne can share his or her experience behind the safety of a monitor or touchscreen, in an incredibly scalable manner. IM is about instant one-to-one communication. It may involve photos, but not for the purpose of mass distribution. So while I maintain IM is an important social tool and Facebook would be served well by having a successful one, it has a very specific use case that gets compromised as soon as you start to add too many social features, like one-to-many photo sharing and long-form written content. This is why Facebook Messenger is an app outside of Facebook.

I don’t think there was ever any really threat of WhatsApp walking into Facebook’s space and I don’t think Facebook thought so either. I’m quite sure Mr. Koum would have coveted Facebook’s $150B market cap instead of a paltry $19B. But what if Google bought them? My hypothesis remains that IM is its own use case. You wouldn’t see an additional 450M Google+ users because of it, they would just be the new owners of a really expensive IM platform.

At this point, though it’s unfair to pass final judgment on the acquisition, my gut tells me this is going to be an extremely hard payoff. Additionally, there are so many other uses for such a crazy amount of capital that it is hard to justify using it on a long-shot bet. But whether you’re for or against it, so far the analysis I’ve read seems to miss very important considerations around the strategy Facebook has employed, the strategies they passed on, and the economic realities surrounding them. Personally, I’d like to hear a lot more from Zuck on how he thinks this will be a successful acquisition for Facebook.