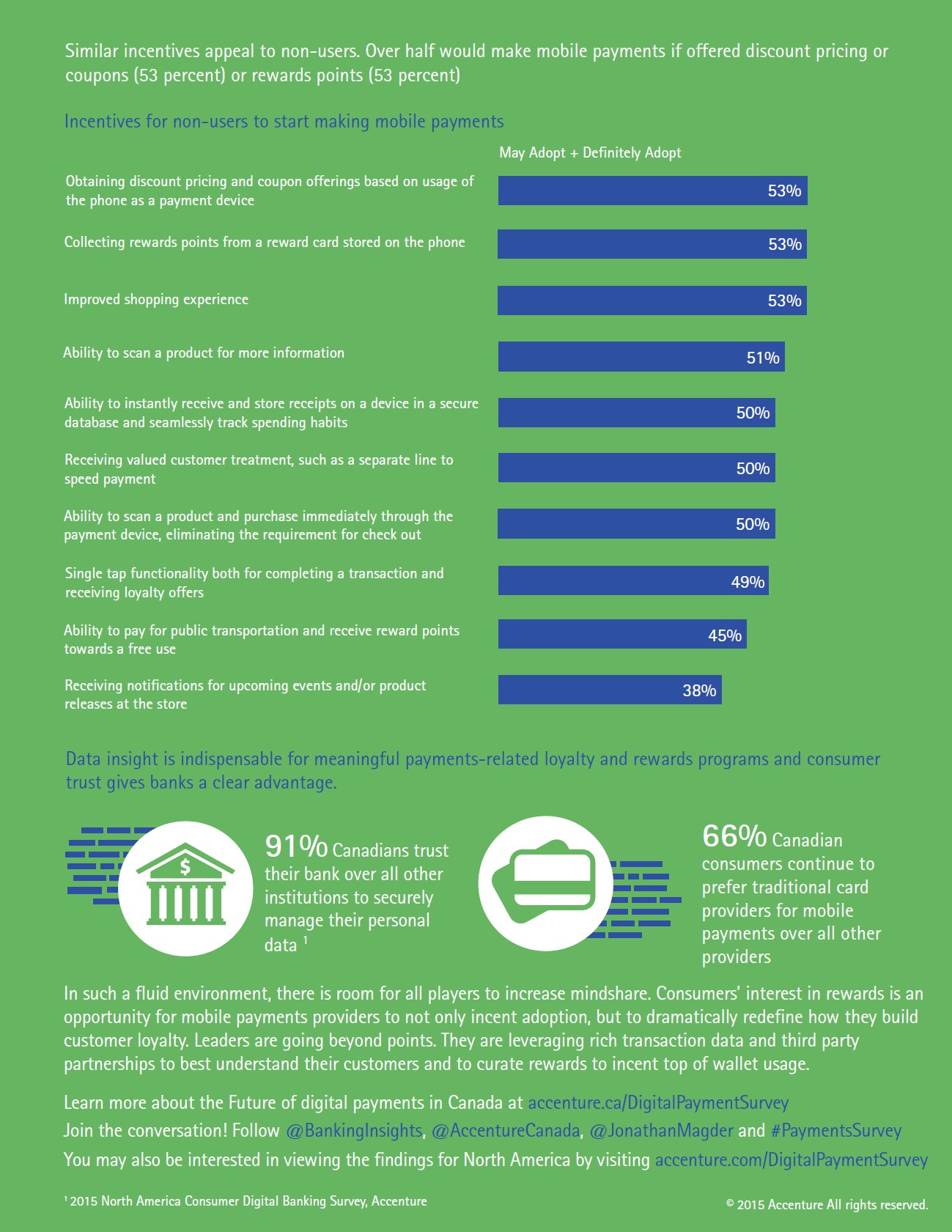

Mobile payments, the act of paying for goods and services with a credit or debit card tied to one’s smartphone, has a long way to go in Canada, according to a new report.

The report, which was conducted by multi-national consultation firm Accenture and gathered data from more than 4,000 smartphone users in both the United States and Canada, found that only 10 percent of Canadians make at least one payment per week using their smartphone. At 19 percent, that number is almost twice as high in the U.S.

Moreover, a modest 40 percent of Canadians, up from 35 percent in 2014, know that they can use their smartphone to pay for goods and services. In the U.S., that number is closer to 53 percent, according to the firm.

It doesn’t take a lot of digging to find the reason for the disparity. For the past year, our neighbours to the south have had access to Apple Pay. Developed by iPhone maker Apple, the platform has quickly become the go-to mobile payments solution for many Americans with about 68 percents all mobile payments in that country being completed with the help of Apple Pay.

By contrast, Suretap, the main mobile payments available in Canada, has yet to catch on in a meaningful way. After two months of availability, the company reported a modest install base of 180,000 individuals. Despite a relationship with one of Canada’s largest carriers, Suretap simply does not have the visibility that its competitor in Cupertino does.

It also must be said the culture surrounding paying for things with a debit card in the U.S. and Canada are vastly different. For the most part, debit cards aren’t a thing in the U.S.

In Canada, however, thanks to organizations like Interac and the technologies they’ve helped developed, including things like the contactless Interac Flash capability that’s built into many new debit cards, the experience of paying for something with a debit card is mostly hassle free. With many merchants supporting point of sales systems that allow people to simply tap their debit card to pay for something, the days of swiping a card or trying to find the right amount of change are, for the most part, gone, and have been for several years now already.

When it comes to the experience of paying for things, Canadians already have it pretty good.

Of course, that’s likely all set to change when Apple Pay finally makes an appearance in Canada, which by all accounts should happen soon. Since its resurgence, Apple has disrupted multiple industries, whether the company is set for a repeat with Apple Pay remains to be seen, but it will certainly have a significant effect on the current landscape when it finally does arrive.

[source]CNW[/source]