On a still-unfinished floor of its expansive new One Market headquarters in downtown San Francisco today, Visa unveiled Visa Checkout, its attempt to simplify and expedite online and mobile payments. The move is meant to make it easier for both consumers and merchants to plug into the robust Visa network, which processes 43% of all Canadian e-commerce transactions today.

Replacing the confusing and under-utilized V.me, Visa Checkout “is not a wallet,” according to CEO Charlie Scharf, but a representation of where the company is moving in facilitating all kinds of payments. “Payments are no longer done with just a plastic card; financial institutions are no longer the only endpoints.”

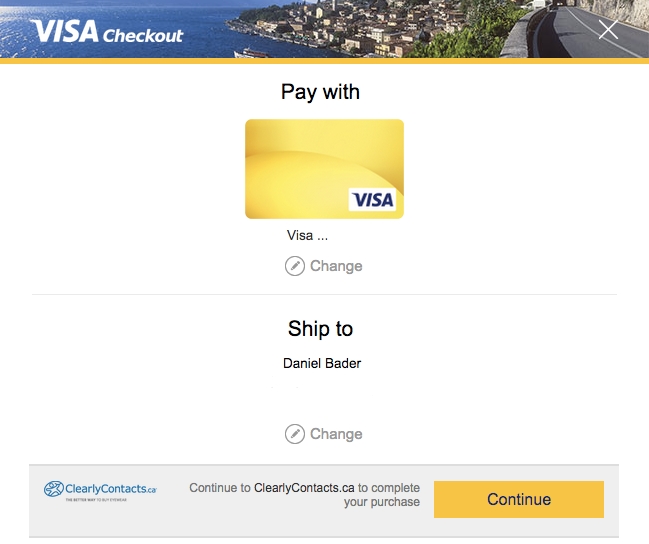

The idea behind Checkout is take the friction away from digital payments, either in a browser or a mobile app. The announcement coincides with a new button that will appear on the pages of select Canadian retailers: ClearlyContacts.ca, Cineplex Entertainment, Beyond the Rack, World Vision, and Cymax Canada are launch partners, with lululemon, Staples Canada, Ticketmaster, Newegg.ca and Tigerdirect coming in next few months.

Customers are able to store multiple Visa credit cards in Checkout itself, along with preferred billing and shipping addresses, facilitating purchases that can be completed in under 10 seconds. Customers can also store credit cards from rivals like MasterCard, Discover, AMEX, as well as Visa Debit cards. The emphasis on this being a payment service and not a wallet is something that differentiates Visa Checkout from MasterCard’s MasterPass product, which performs a similar function in the checkout chain but also doubles as a place to store loyalty cards.

Brian Weiner, Visa Canada’s VP of Product and Strategy, said that the goal of Checkout is to significantly cut cart abandonment, which is often the cause of having to register with a retailer and repeatedly enter one’s personal information. “Visa Checkout provides Canadian consumers a simplified and secure online checkout experience, from the Visa brand and an issuer they already know and trust.”

The trust portion is key: Visa is one of the most trusted brands in the world, up there with companies like Apple, and moves millions of peoples’ payment credentials every day. By necessity, moving from a physical to digital layer adds a significant number of security considerations, so a product like Checkout takes the onus away from merchants to process and store those credentials.

“We want to be the shortest distance between you and your favourite thing,” says Visa, so Checkout functions as a pop-over on top of the merchant’s website or, in an app, as a single login. Once logged in, the buyer can choose which card he or she wants to use, along with the desired destination, and complete the process much faster than before.

Visa is also expanding its partner network to include companies like PayPal, Facebook, Square, Google, Samsung, Vodafone and others, made easier by the fact that the Checkout SDK, available today for iOS and Android, allows developers to create in-app purchase experiences without having to process the payments themselves. It’s important to note that while the SDKs are platform-specific, the end user experience will be available on any mobile device with a compatible browser, such as Windows Phone and BlackBerry 10.

The company intends for the Checkout experience to be identical across screen sizes and platforms, and a single login, using either email or a phone number, provides access to the service in any situation.

Its biggest challenge will be getting users to create an account over a competing quick-payment solution like MasterPass or PayPal, both of which offer the ability to complete transactions quickly using the web, mobile web, or inside native apps.

Visa’s advantage, at least from this vantage point, is speed and brand recognition, along with the cooperation of some of Canada’s largest e-retailers. But at the end of the day it will come down to scale — and trust — and Visa has plenty of both.