The latest rumour to circle about BlackBerry is not a new smartphone, but that the company is entertaining the idea of going private. Reuters “several sources familiar with the situation” revealed that the board is favouring this route and believe being a private company “would give them breathing room to fix its problems out of the public eye.” The company noted in the report is private equity firm Silver Lake Partners, same company who’s behind Dell’s current private dealings, but they make it clear that “no deal is imminent” and “BlackBerry has not launched any kind of a sale process.”

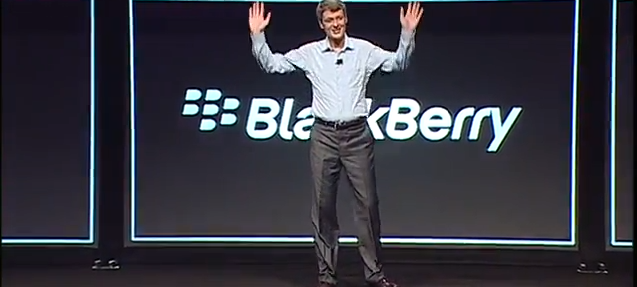

Ever since Thorsten Heins, BlackBerry’s CEO, took over the reins he stated that the company was not for sale, but could potentially look at licensing BlackBerry 10 to other manufactures. In an interview last year Heins stated “We don’t have the economy of scale to compete against the guys who crank out 60 handsets a year. We have to differentiate and have a focused platform. To deliver BB10 we may need to look at licensing it to someone who can do this at a way better cost proposition than I can do it. There’s different options we could do that we’re currently investigating.”

BlackBerry reported 6.8 million smartphone shipments last quarter and revenues of $3.1 billion, but also recorded an operating loss of $84 million.

Source: Reuters