Shocking revelation today about BlackBerry.

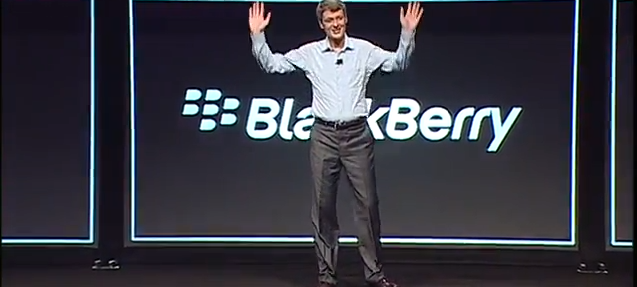

According to a report in the Globe and Mail this morning, Thorsten Heins, President & CEO of BlackBerry, has been let go and will be replaced. The company is also making some sweeping changes to its executive team and board makeup, though nothing has specifically been announced.

The move comes after the $4.7 billion buyout deal from Fairfax Financial Holdings, the company’s biggest single shareholder, reportedly died over the weekend, as the consortium could not raise the necessary funds to go through with the transaction. Instead, BlackBerry will attempt to raise $1 billion by selling convertible bonds that can later be turned into shares. This round of investment includes Fairfax Financial, who will “invest in BlackBerry through a U.S. $1 billion private placement of convertible debentures. Fairfax has agreed to acquire U.S. $250 million principal amount of the Debentures. The transaction is expected to be completed within the next two weeks,” according to a press release issued this morning.

The bonds will be turned into BlackBerry shares at a price of $10/share, which is a huge premium over the current stock price (especially today, as the stock is down 20% in early trading to $7.50).

When the deal closes, John S. Chen will become BlackBerry’s new interim CEO and Executive Chair of BlackBerry’s Board of Directors. He was CEO of Sybase until early this year, and stood on the board of directors for Wells Fargo and Disney. He was also an advisor to Silver Lake, an investment firm. Prem Watsa, Fairfax CEO, will become Lead Director and Chair of the Compensation, Nomination and Governance Committee.

While Heins is leaving the company as CEO, Chen will only serve as interim CEO while the hunt continues for a new leader. Barbara Stymiest will say on as BlackBerry’s Chair.

Update: According to an SEC filing, Fairfax’s partners in the $1 billion debt deal include Mackenzie Financial Corp., Brookfield Asset Management Inc., Markel Financial, Canso Investment Counsel Ltd. and Qatar Holding LLC.

[source] The Globe & Mail, Marketwired[/source]