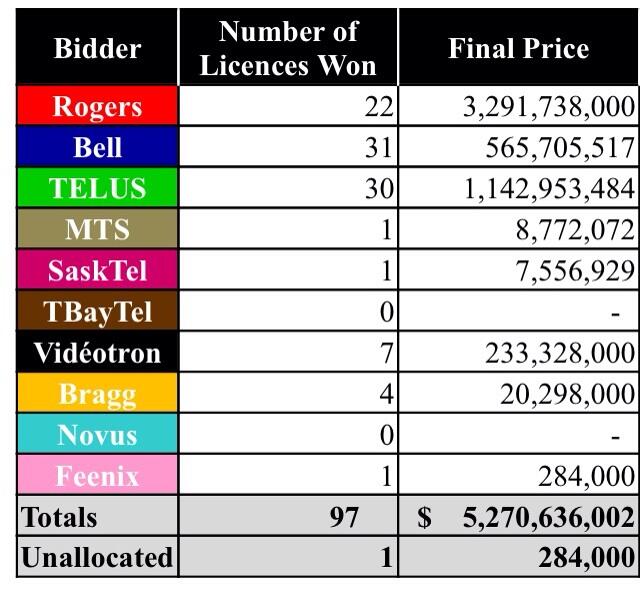

The government of Canada has announced the results of the 700MHz spectrum auction, and the number raised is much higher than initially speculated. With a total of $5.27 billion raised across 14 regions, with eight participants, the results are more tantalizing than they could have otherwise been.

One of the main winners is Quebecor, owner of Videotron, which previously purchased AWS spectrum in Quebec and Eastern Ontario during the 2008 auction. This time, the company spent $233 million for prime spectrum in Ontario, British Columbia and Alberta, as well as Quebec with a total of 17 total licenses in seven markets. Rogers was the big winner, spending $3.3 billion across 22 markets. TELUS was next with $1.1 billion for 31 licenses, while Bell spent just under half that amount — $565.8 million — for 31 licenses.

According to the output, Rogers spent far more than TELUS and Bell combined because it chose to bid on only paired blocks, considered the “prime” real estate of the spectrum auction. Unpaired spectrum is not as efficient to deploy, and has less interoperability between carriers, which affects roaming agreements.

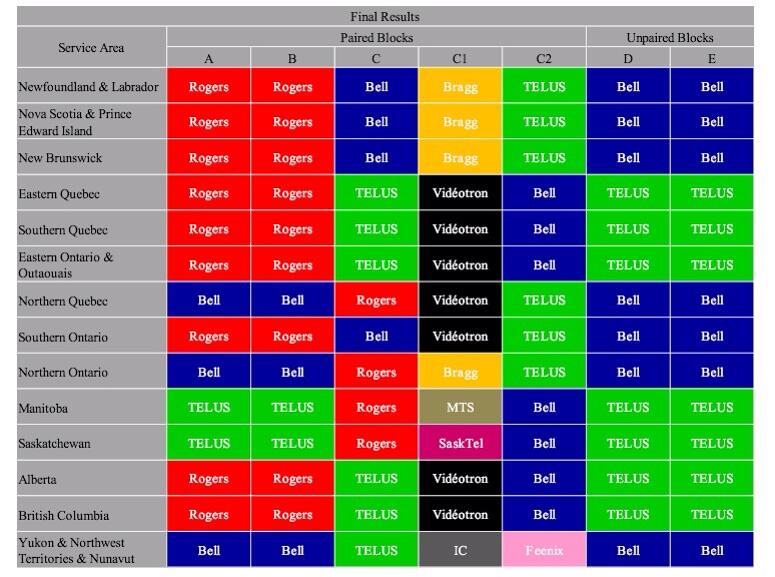

Rogers purchased A and B block spectrum — which is aligned with AT&T in the US — in almost every eastern province, excluding Northern Ontario and Northern Quebec, while TELUS outbid them in Manitoba and Saskatchewan.

Bell chose to focus on C block in the Eastern provinces and Southern Ontario, bolstering its spectrum in those provinces; TELUS took C block spectrum in its core regions of Alberta and British Columbia. Though the two companies did not explicitly comment on it, they are presumed to continue their tower and spectrum sharing agreement, which began with the simultaneous launch of an HSPA+ network in 2009. The cumulative bids of $1.7 billion combined to just over half of Rogers’ $3.29 billion, but the latter claimed the “beachfront” property of the 700Mhz auction.

Videotron’s seven licenses were all in the upper C1 block, which is interoperable with Verizon in the States. Bragg, owners of Eastlink, purchased paired upper C1 spectrum in the Maritimes and Northern Ontario.

The other upper paired block, C2, (also owned by Verizon down south) was shared between TELUS and Bell in all provinces but Yukon & Northwest Territories & Nunavut, which was acquired by Feenix Wireless — though it’s unclear what the John Bitove-owned holding company will do with the spectrum. MTS and SaskTel both purchased a single block of upper C1 paired spectrum in Manitoba and Saskatchewan respectively.

Industry Minister, James Moore, said during a press conference that “this is a great day for consumers,” and that it is “great” that there will be a fourth competitor in Ontario, Alberta and British Columbia. At this point, though, it’s unclear what Videotron plans to do with the spectrum, though the best case scenario is that they will expand the wireless provider’s service into those provinces.

TBayTel and Novus, two qualified participants, did not bid in the auction. A 20% down payment on the blocks is due on March 5th, with the balance due on April 2nd. Until then, the companies cannot talk to one another about the results.

By purchasing the bulk of block A and B in the most populated regions of Canada, Rogers adds to its cache of wireless spectrum, which already exceeds that of Bell and TELUS in most of the country. Industry Minister Moore refused to speculate on what would happen with Mobilicity’s AWS spectrum, which is held in key areas like Southern Ontario, Alberta and British Columbia.

He reiterated that the government’s rules on transferring spectrum to incumbents that would result in “undue concentration” still apply, so it’s unlikely that TELUS will get its wish in that regard. Considering Mobilicity just asked a court for an extension on repaying its debts, it’s clear there is still no buyer in site. Speculation on a “dream team” combination of Videotron, Mobilicity and WIND to take on the incumbents is still alive, but it would take a lot of wrangling to turn that into a fourth national carrier.

Though the amount of spectrum auctioned off was less (60Mhz) than the AWS auction in 2008 (100Mhz), the government raised just under a billion dollars more this time around. And while Rogers purchased 12Mhz of 700Mhz spectrum, less than TELUS’ 16.6Mhz, it is considered of higher quality. Rogers also has more spectrum overall than any other telco in Canada, as it currently uses 850/1900 for 3G and both AWS and 2600Mhz for LTE; adding the A and B blocks to that cache is what new CEO, Guy Laurence, says is “the best for the next 20 years,” referring to the 20-year license period. Being contiguous spectrum (paired spectrum placed side by side) will also help Rogers deploy intra-band carrier aggregation.